Spread betting is where it’s at for the cool kids of gambling. There’s a lot of buzz around it because it’s considered a good way to get rich quick.

That’s a load of b**locks, of course. It’s still gambling, so there isn’t a foolproof way to make money. Success in spread betting rests on too many factors for anyone to predict with unfaltering accuracy.

That’s not to say that there aren’t strategies that can help you get an edge, but they’re difficult to learn and most people suck at them.

What the heck is spread betting?

You’re reading this article because we wrote it for beginners. Naturally, you won’t have in-depth knowledge of spread betting, and you might not know what it is at all, so this section’s for you.

Spread betting has been around since the early 70s and is effectively a hybrid between traditional gambling (especially sports betting) and trading, with perhaps slightly more emphasis on trading.

Now, some people would have a problem with that last paragraph. These ones will tell you that there’s a significant difference between gambling and trading and how dare you suggest otherwise!

But it does involve speculation. The definition of “speculate” within trading is, “investment in stocks, property, or other ventures in the hope of gain but with the risk of loss.” So there is a risk of loss.

With spread betting, you speculate on financial markets. This is not like traditional trading, where you’re trading on specific commodities, stocks, shares or currencies (i.e., assets). Instead, you’re betting on the overall fluctuations of the market.

So, it’s sort of like a meta-bet. You aren’t betting on the individual underlying assets, but on how the entire market fluctuates. You are speculating/betting on whether a market will rise or fall.

Yes, it’s complicated, but keep reading because we’re going to make it easy for you to understand.

Some key terms you need to understand first

You don’t buy the assets within the market, but you need to understand the following four concepts:

-

-

-

- Position = the current bet that you have on. If you’ve put a bet on the FTSE 100, you say you have an “open position in the FTSE 100”.

- Short/long trading = this is a bet on whether you think the market will fall (short) or rise (long). Be careful with the terminology because long and short can also refer to the amount of time you choose to hold onto your position – i.e. the duration of your bet.

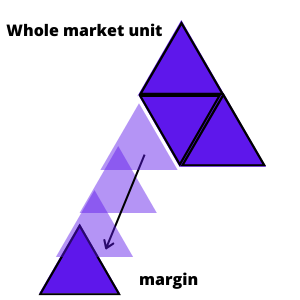

- Margins (aka Notional Trading Requirement or [NTR]) = the money you pay to open a position. You have to have a specific amount of money in your spread betting account if you want to place a bet. The margin is a fraction of what it would ordinarily cost to buy a market unit share – your broker foots the rest of the bill.

- Leverage (aka Gearing) = the relationship between your initial outlay (i.e., margin) and the amount you could win or lose. It’s how much the broker is willing to lend you and at what interest rate. High leverage refers to the probability of making either a big loss or a big win (depending on whether your bet works out or not) – you’ve borrowed a lot of money on a risky bet.

-

-

This is the basic terminology you need to understand to get a decent beginner’s grasp of spread betting.

Understanding spread

The spread is the difference between the buying and selling price of the market unit you’re betting on.

When you buy your position, you will be given a choice of two prices:

- The buy price (the long position)

- The sell price (the short position)

If you think the market is going to increase in value, you buy in at the buy price.

If you think the market is going to decrease in value, you buy in at the sell price.

The difference between the buy price and the sell price = spread.

Understanding bet size

This is the amount of money that you want to bet on the particular market unit. You can bet as much as you want, but there is a lower threshold.

The more the market moves in the direction you predicted, the more money you’ll make.

An example of how profit and loss relates to bet size:

You place a £5 bet on the long/buy position. Your margin (£5) represents 10% of the market unit (which is sort of like a share of the entire market), so your broker has lent you £45 (£45+£5= £50, £5 margin is 10% of 50 – this relates to leverage, more on that below).

If the market grows by 10%, that means the market until (£50) is now worth £55. You make £5 on a 10% growth. If it grows 20%, you make £10. You can see how profits quickly accumulate. With only 10% growth, you’re making 100% profit.

That’s if you’re speculation was correct. If you’re wrong, the opposite happens: a 10% drop on a long/buy position means you lose your deposit and you owe an extra £5 (although most brokers will stop your halt your position before that happens, but not always, so watch out!).

Understanding leverage and margin

Leverage allows you to take advantage of the entire movement of the market unit whilst only paying for a small representative section of it (the margin).

Effectively, you’re buying a fraction of the market unit that reflects the entire market unit. The rest of the money (i.e. the money that it would cost you to buy an entire market unit) is put up by the broker you’re using to make your spread bet.

A simple example of spread betting

If you’re betting on the FTSE 100 and it currently has a market unit cost of £1000. You can go to your broker and pay for a margin at a buy price of, say, £100. You then borrow £900 from the broker to make up the full £1000 (this £900 never goes into your account – they handle the actual placing of the bet).

This means you’re getting the full benefit (or loss) of placing the £1000 bet, but only need to fork out £100. If the value of the market unit goes up by 10%, you get a £100 return on your £100 investment, minus the broker fees. If it goes down by 10%, you lose your £100. If it goes down by 20%, you can owe £100 on top of losing your deposit!

The exact details of the bet will vary from broker to broker and whether you’re opting for a long or short position. They’ll be differences in the fees you pay, the risks of winning/losing, the expiry dates, etc.

How long can you keep a position open?

Margins come with expiry times. Once that time’s up, that’s the end of the bet and you either win or lose. You can’t hold onto the bet in the hope that your investment gets bigger if you made the right call, or in the hope that your debt gets smaller if you made the wrong call.

However, there are different expiry times on different spread bets. You can also choose to end a bet early in most cases. So you do have some control of this.

But which markets can you bet on?

You can bet on thousands of financial markets around the globe, including all the big ones, e.g. DOW, NASDAQ, FTSE, DAX, CAC, TSE.

What are the benefits of spread betting?

There are several benefits of spread betting. Firstly, in the UK (as far as we’re aware, but this may change), any profit you make is tax-free.

The rewards can be much higher and arrive much sooner than with traditional trading.

What are the risks of spread betting?

Because of leverage, there’s a big danger with spread betting: it will quickly amplify losses. People lose money all the time and it’s incredibly high risk.

You’re probably better off sticking to the slot machines!