At Online-Casinos.co.uk, we provide in-depth UK online casino reviews, gambling tips, game guides and more to help you have the best and safest online gambling experience.

If you’re looking for the best online casinos in the UK in April 2024, look no further! Our curated list of the top 20 online casinos in the UK has exactly what you’re looking for! Visit the best UK casinos online where you can play the latest and greatest versions of roulette, slots, and blackjack. We’ve picked out the best online slot providers so you can play safely and win real money.

Only the top 20 best rated UK casino sites and UK Gambling Commission Licenced casinos are listed! Keep an eye out for our *exclusive* bonuses only available here.

Battle of the Best: Comparing the Top 20 Online Casinos in the UK

STRICTLY 18+ Gambling can be addictive. Play responsibly. Contact Gamcare for support. We receive referral commission for listed casinos which is why we only list the most trustworthy and established casinos.

Stay with us to find out more about the best top-rated UK online casinos in April 2024. Check the UK casino list above and play online casino games safely.

Compare the Top 20 UK Online Casinos – Best UK Casino Sites [Full Details]

Play Frank

- Uses 128-bit Secure Socket Layer (SSL) encryption for more security

- One of the best welcome bonus casinos in the UK

- Many different progressive jackpot slots.

Bonus Terms

New players only. Min deposit £20. Bonus to a max of £100 spins 50. Wagering for bonus 35x. Wagering for bonus spins 35x. The winnings must be wagered within 21 days. Bonus T&C apply.

100% up to £100 plus 50 bonus spinsOnline Casino: Play Frank

Established: 2015

Company: ASG Technologies Ltd

UK Gambling License link: 39483

Banking options: Credit and debit cards (Visa, Mastercard, Maestro), Online Bank Transfer,Sofort,Trustly,Skrill, Skrill 1-tap,NETELLER, ecoPay, PayPal, GiroPay, Interac, AstroPay Card, MuchBetter, Euteller, EPS & Paysafecard

Mobile options: Optimized mobile website version

Review: Play Frank Casino Review

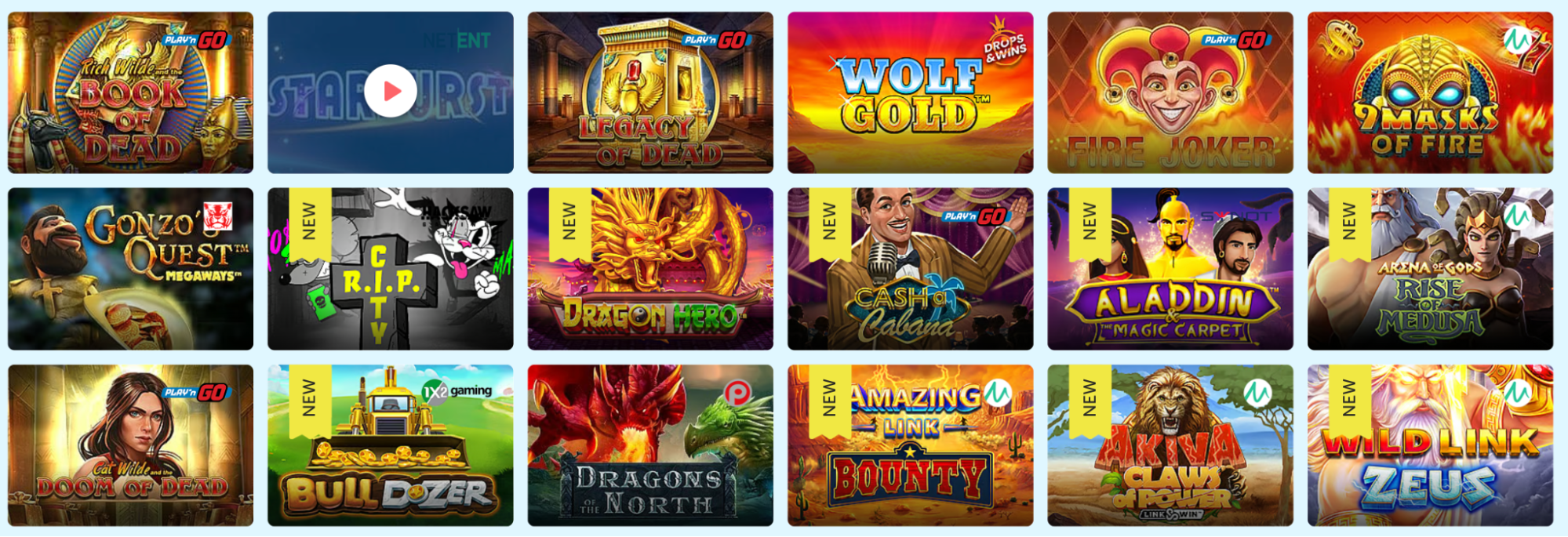

Nowadays, with the growing number of online casinos, it may be challenging to find a good one. So if you are confused about which online casino to check out, why not try Play Frank Casino? Play Frank is an online casino known for having one of the best welcome bonuses in the UK. On top ... READ FULL REVIEW

- Evolution Gaming

- IGT

- iSoftBet

- NetEnt

- Play 'N Go

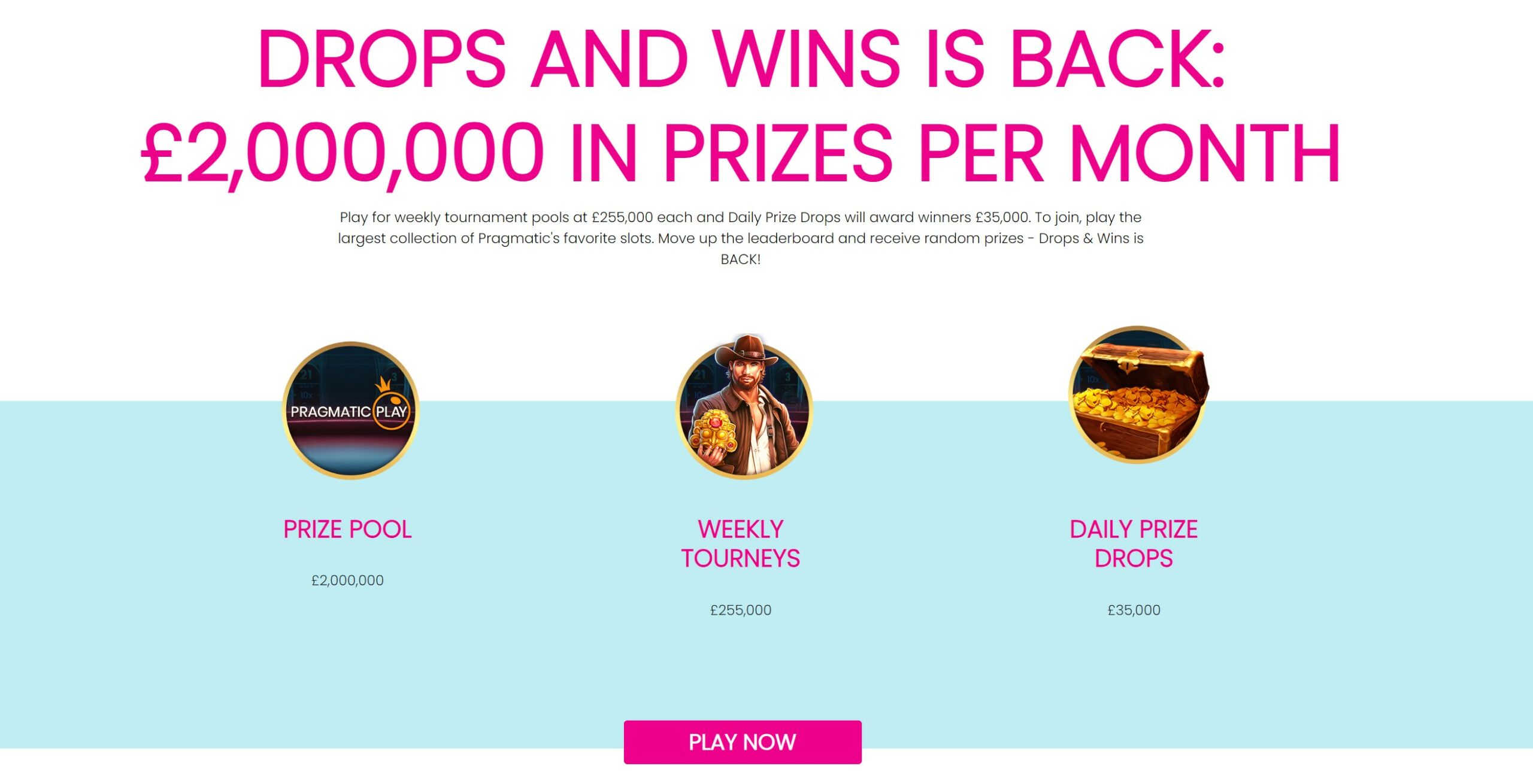

- Pragmatic Play

- Quick Spin

- Red Tiger

- User-friendly Interface

- Fast Payouts

- Various Bonuses

- Reliable Customer Support

- Thorough FAQ Section

- High Wagering Requirements

- No Mobile App

- No VIP Program

Bonus Terms

New depositing players only. Min.1st deposit £10. Min. 2nd and 3rd deposits £20. First deposit is 50% bonus up to £50 + 20 Spins on Starburst; second one is 50 % Bonus up to £75 + 40 on Book of Dead; third deposit brings 50 % Bonus up to £75 + 40 on Legacy of Dead. Bonuses that require deposit, have to be wagered 35x. Deposits may be withdrawn before a player’s wagering requirements have been fulfilled. However, if this occurs, all bonuses and winnings will be voided. Winnings received through the use of the extra bonus (no deposit) or extra spins shall not exceed £100.

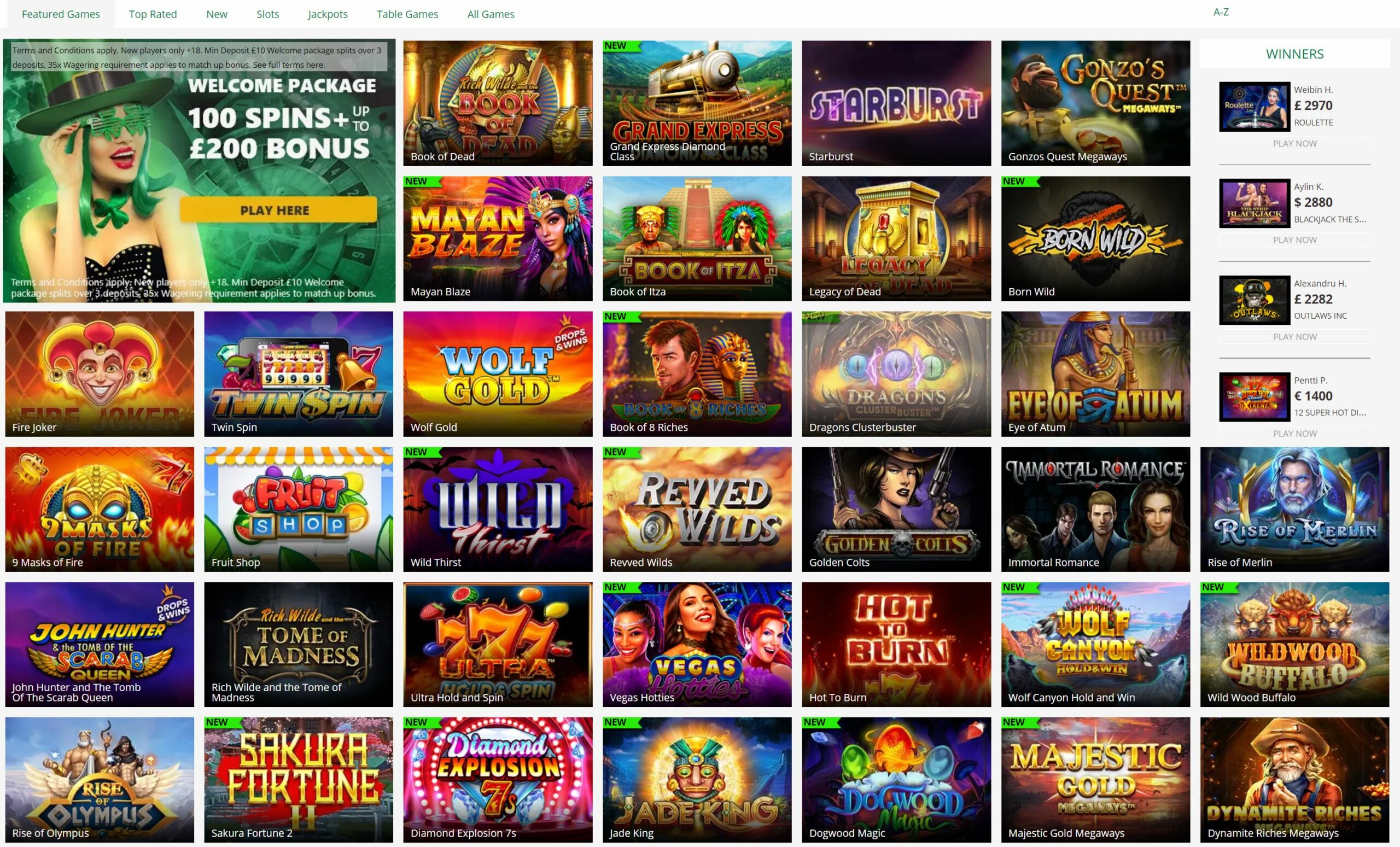

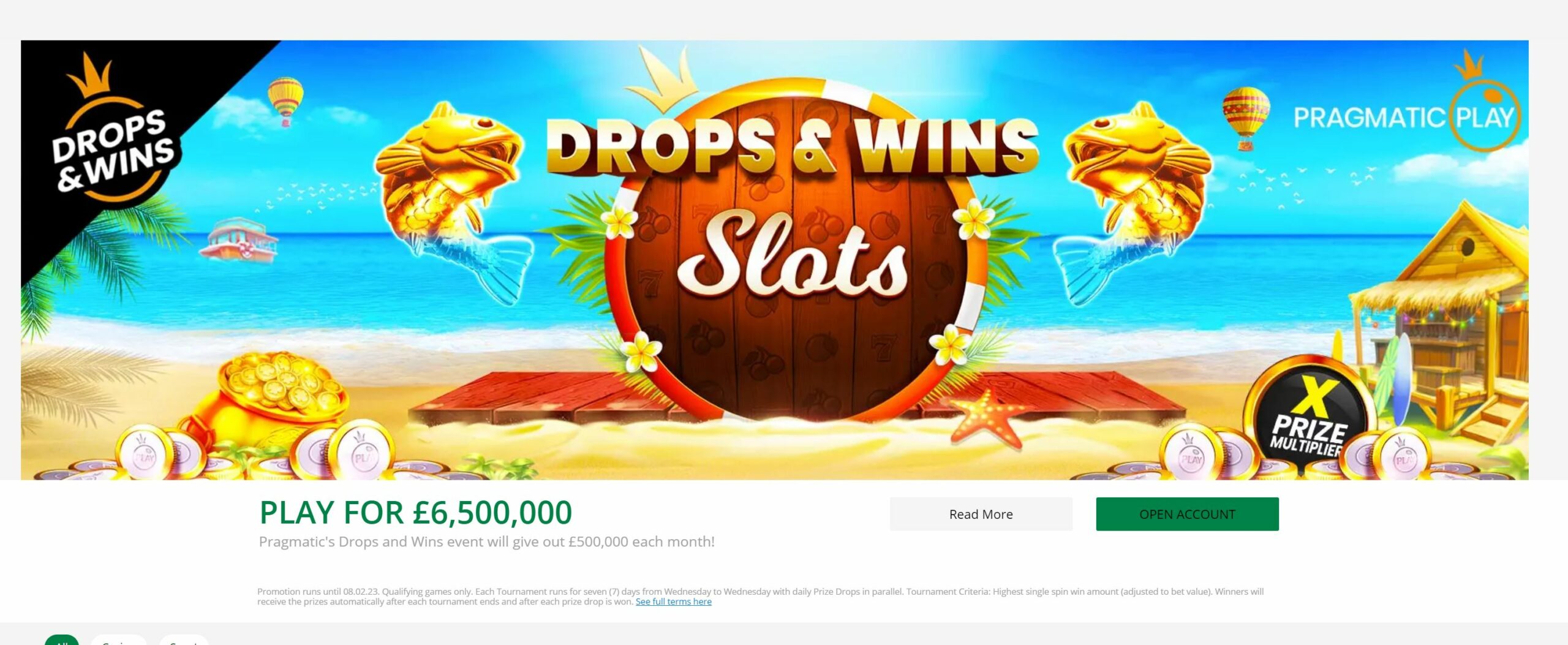

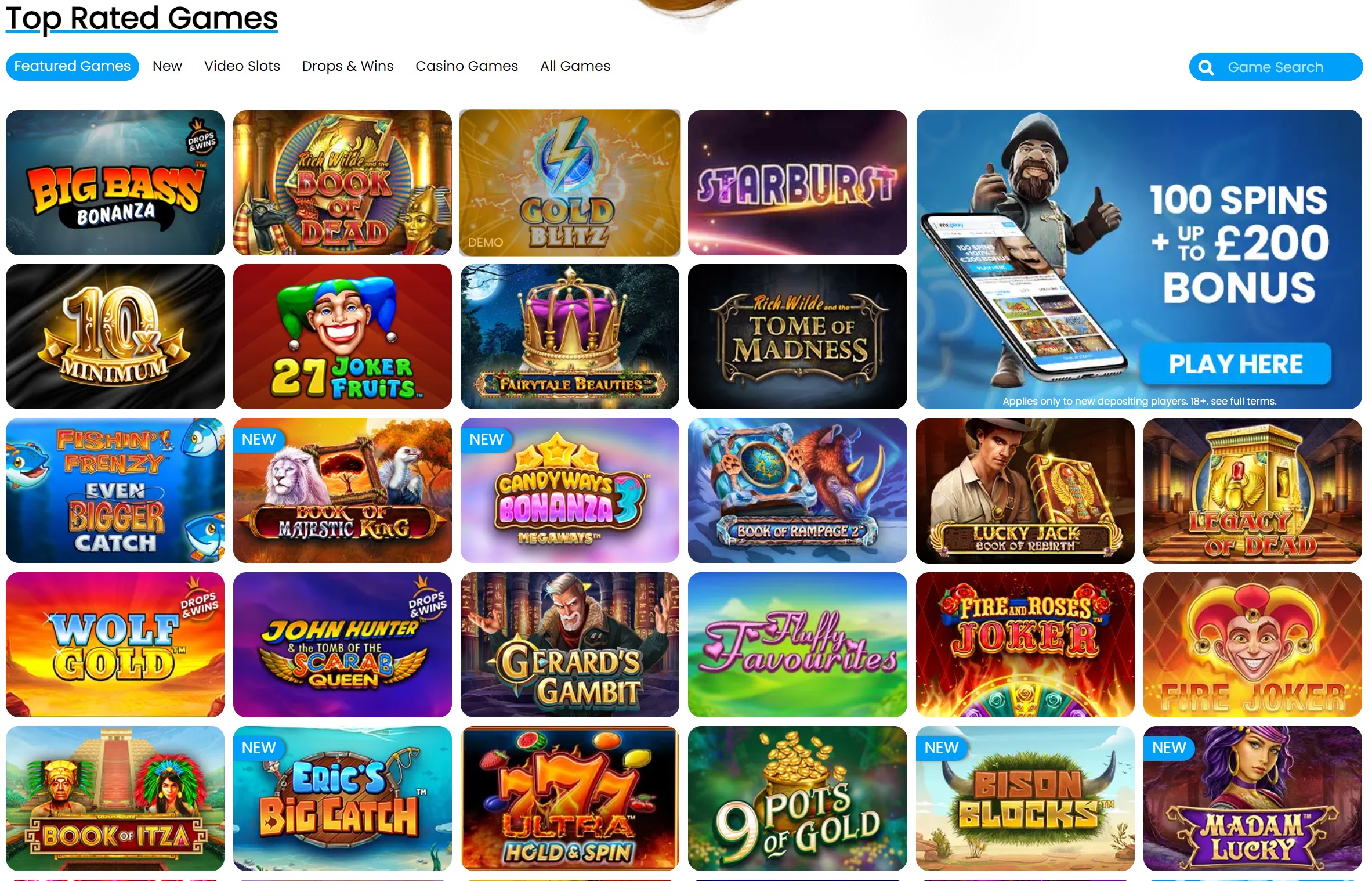

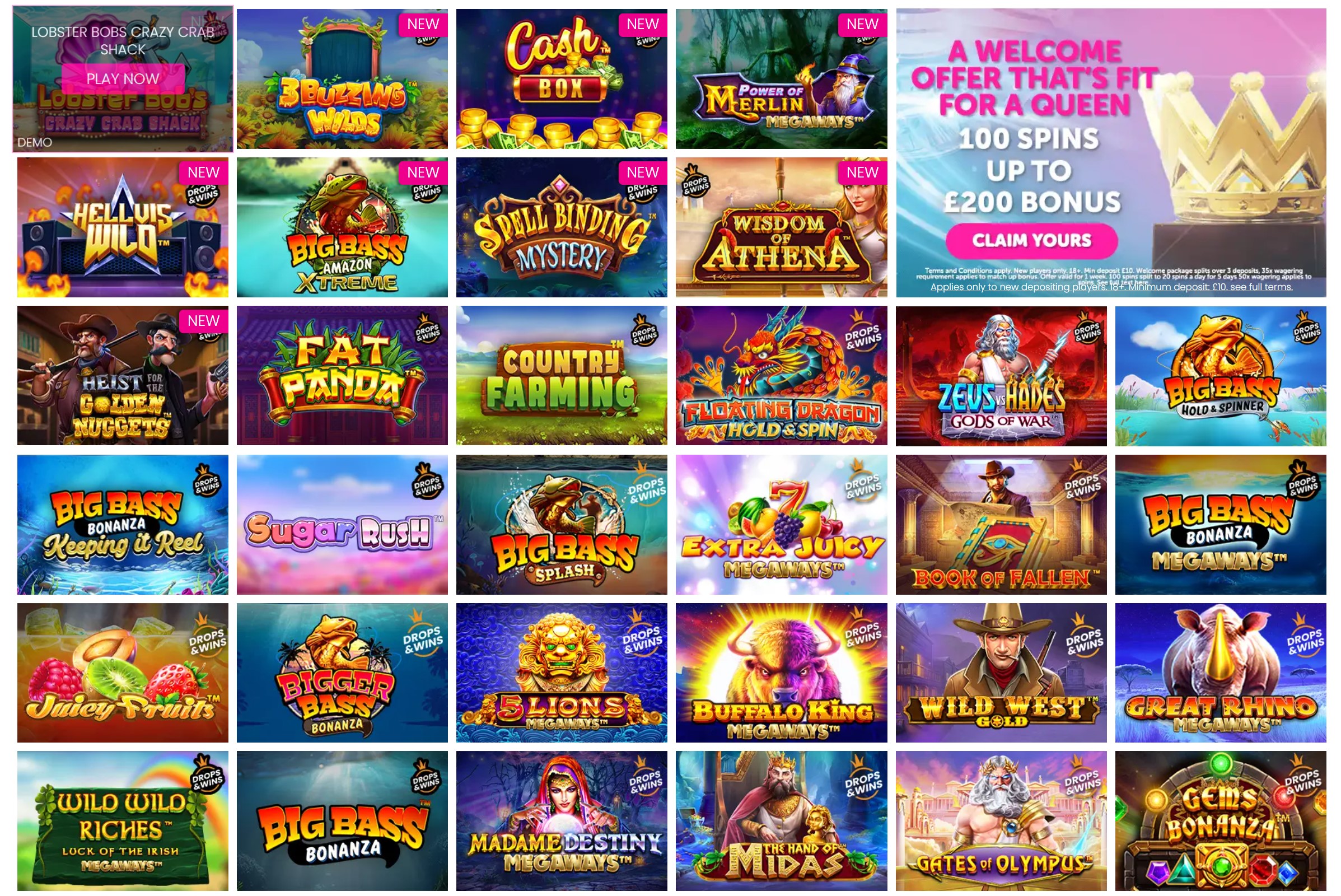

100 spins + bonus up to £200Online Casino: Vegasland * NEW *

Established: 2022

Company: Marketplay Limited

UK Gambling Licence link: 39483

Platform: Aspire Global

Banking options: Bank Wire Transfer, EcoPayz, MasterCard, Neteller, Paysafe Card, instaDebit, Visa, Entropay, EPS, Euteller, Bancontact/Mister Cash, Fast Bank Transfer, Trustly, Skrill, Wire Transfer, Skrill 1-Tap, Zimpler, Klarna Instant Bank Transfer, MuchBetter, Rapid Transfer, PayPal, Interac, AstroPay Card, CashtoCode, GiroPay

Mobile options: Over 1100 mobile games

If you are looking for a casino with a huge library of slot and live dealer games and a variety of sports you can bet on, VegasLand Casino is exactly what you are looking for! Not only can you play your favorite games both on your desktop and mobile browser, but you can also ... READ FULL REVIEW

- 1X2gaming

- Ainsworth

- Aristocrat

- Bally

- Barcrest

- Betsoft

- Big Time Gaming

- Blueprint

- Booongo

- Cadillac Jack

- Elk Studios

- Evolution Gaming

- Ezugi

- GameArt

- Habanero

- High 5 Games

- IGT

- Inspired

- Irondog

- iSoftBet

- Lightning Box

- Magnet Gaming

- Microgaming

- NeoGames

- NetEnt

- NextGen

- Nolimit City

- NYX

- Old Skool Studios

- Oryx

- Pariplay

- Play 'N Go

- Playtech

- Pragmatic Play

- Quick Spin

- Quickfire

- Rabcat

- Realistic

- Red Rake

- Scientific

- SG Digital

- Skillzzgaming

- SYNOT

- Thunderkick

- Tom Horn Gaming

- Triple Edge Studios

- WMS

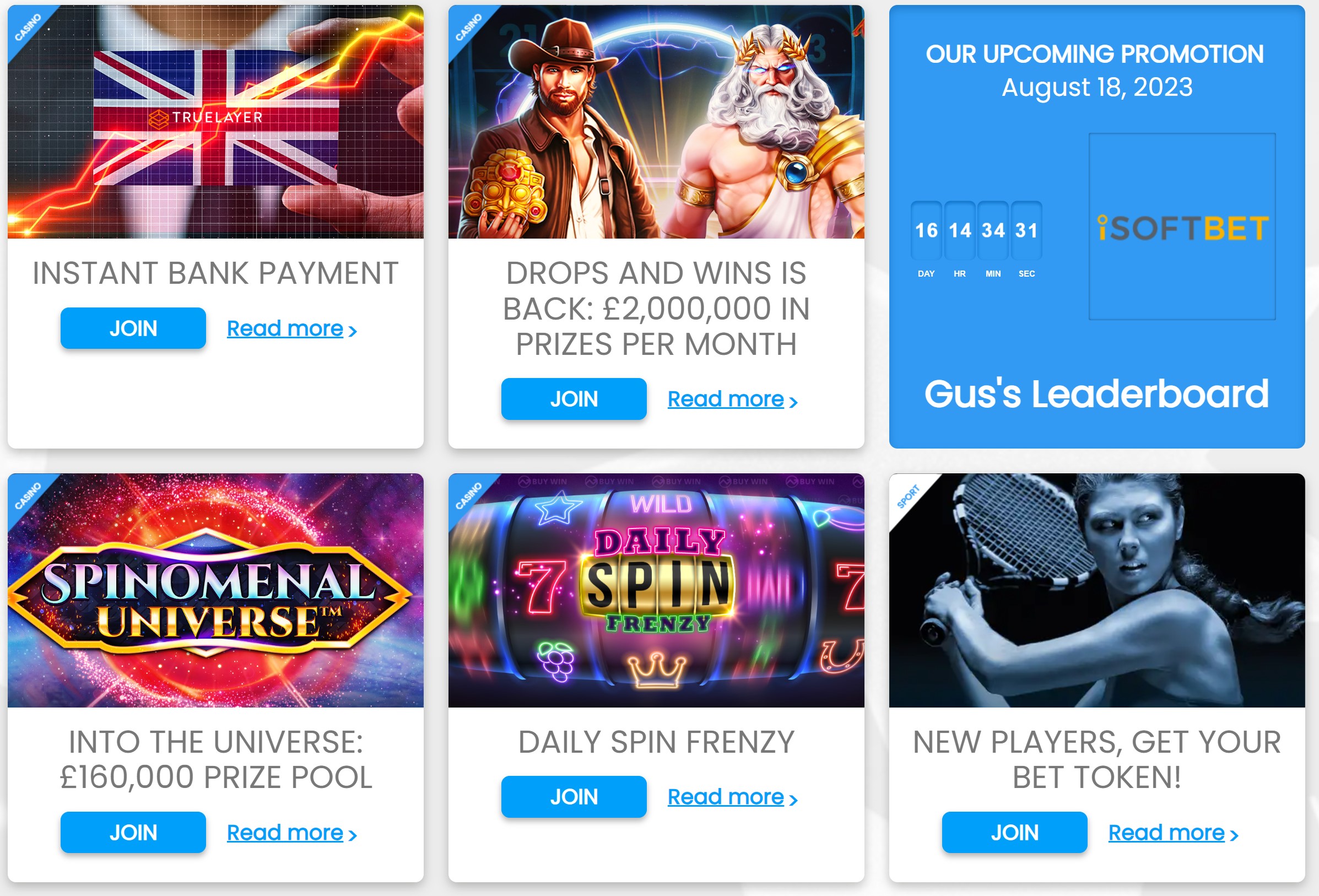

- Daily Spin Frenzy

- Integrated Sportsbook

- Established Company

- No USA players

Bonus Terms

18+. New Players Only. Spins are given as follows: 50 Spins upon a first deposit of minimum £10. Spins may only be used in specific games. The game allowed: Book of Dead. Wagering Requirement: 35x. Spins expire after 24 hours. Promotion available for 72 hours. Maximum winnings from spins: £100. Terms and Conditions apply.

100% up to £35 + 50 spinsOnline Casino: Magic Red

Established: 2014

Company: Eshkol

UK Gambling Licence link: 39483

Platform: Aspire Global

Banking options: Paypal, Bank transfer, VISA, Debit Card, Trustly, Much Better, Astropay, Paysafecard

Mobile options: Over 1300 mobile games

Life is too short not to try out new things. But when your money is at stake, wanting to play it safe is natural—after all, you’re risking not only your money but your credentials as well. That is why, to let you try it out and be certain it’s safe, we’ve done the MagicRed ... READ FULL REVIEW

- 1X2gaming

- Ainsworth

- Aspire Global

- Atomic Slot Lab

- Authentic

- Bally Wulff

- Betixon

- Bluberi

- Blueprint

- Booming Games

- Evolution Gaming

- Eyecon

- G Games

- Gaming Realms

- Green Tube

- Hacksaw Gaming

- IGT

- Indigo Magic

- Inspired

- iSoftBet

- Lightning Box

- Microgaming

- NetEnt

- NextGen

- Pariplay

- Play 'N Go

- Playson

- Playzido

- Pragmatic Play

- Quick Spin

- Realistic

- Red Rake

- Red Tiger

- Ruby Play

- Scientific

- Skillzzgaming

- Skywind

- Slotmill

- Spinberry

- Spinomenol

- Spribe Gaming

- Stakelogic

- SYNOT

- Wazdan

- 10% Weekend Cashback in Live Casino

- Magic Spins Tuesdays

- Fast Payouts

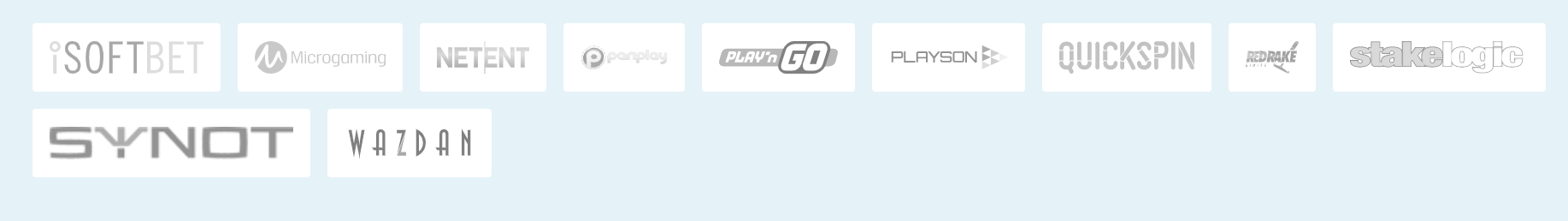

- New Drops & Wins

- Basic desktop layout

- No live chat

Yeti

- 256-bit encryption technology for data protection

- Uses KYC procedure

- Customer support via Live Chat

Bonus Terms

18+, min deposit £10, wagering 60x for refund bonus, max bet £5 with bonus funds. Free Spins bonus has x40 wagering. 23 free spins on registration (max withdrawal is £100). 100% refund bonus up to £111 + 77 spins on 1st deposit. No max cash out on deposit offers. Eligibility is restricted for suspected abuse. Welcome bonus excluded for players depositing with Ecopayz, Skrill or Neteller. Full T&Cs apply 18+, BeGambleAware, #Ad

100% refund bonus up to £111 + 100 extra spinsOnline Casino: Yeti

Established: 2017

Company: L&L

UK Gambling Licence link: 38758

Platform: L&L

Banking options: Instant EFT - ZA, Skrill, Neteller, EcoPayz, MuchBetter(IN), Jeton - (IN), Visa, Mastercard, Paysafecard, Trustly, Euteller, Zimpler, PayPal UK, Poli, Instant Transfer through Netbanking (IN), UPI (IN) Bank transfer ApplePay (UK/SE/NZ).

Number of games: Over 1900

If you’re looking for a place to play some casino classics such as slots, blackjack, roulette, or others, you’ve come to the right place! Have you heard of Yeti Casino?

Yeti Casino has everything a typical gambler could want—generous bonuses, high-quality games, tournaments, reliable customer support, and more. But what makes this place special in comparison to other online casinos in the industry?

This Yeti Casino review will provide you with all the answers and help you decide whether you should check it out or not.

So, let’s see what it’s all about!READ FULL REVIEW

- 1X2gaming

- Amatic

- Bally

- Barcrest

- Blueprint

- Elk Studios

- Evolution Gaming

- Eyecon

- High 5 Games

- Irondog

- JustForTheWin

- Lightning Box

- Merkur

- Microgaming

- NetEnt

- NextGen

- Nolimit City

- Novomatic

- NYX

- Play 'N Go

- Pragmatic Play

- Scientific

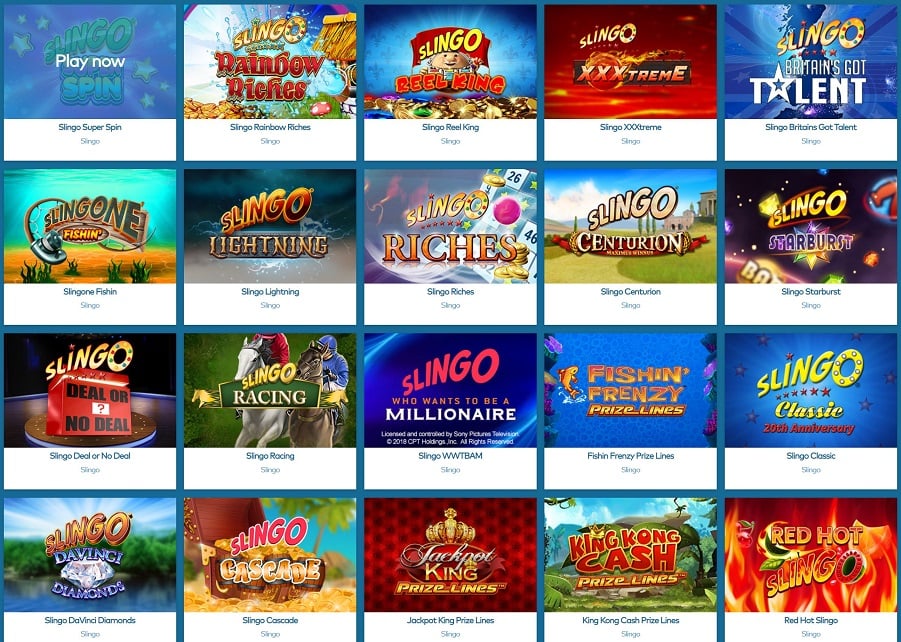

- Slingo

- Thunderkick

- WMS

- Fast Payout Times

- Numerous Bonuses and Promotions

- Outstanding Customer Support

- Monthly Tournaments

- A Wide Range of Slingo Games

- High Wagering Requirements

Bonus Terms

Welcome package includes 3 deposit bonuses as follows: First Deposit: 100% up to £50 + 20 Spins on Starburst *Min. Deposit £10 Second Deposit: 50% up to £75 *Min. Deposit £20 Third Deposit: 50% up to £75 *Min. Deposit £20 After first deposit made, customers will get + 20 Spin for the next 4 days: 1st day after First Deposit: 20 Spins of Finn and the Swirly Spin 2nd day after First Deposit: 20 Spins of Book of Dead 3rd day after First Deposit: 20 Spins of VIP Black 4th day after First Deposit: 20 Spins of Aloha! Cluster Pays Winnings won with spins that require deposit, have to be wagered 35x. Bonuses that require deposit, have to be wagered 35x.

100% bonus up to £50 + 20 spinsOnline Casino: Luckster

Established: 2021

Company: Marketplay Limited

UK Gambling Licence link: 39483

Platform: Aspire Global

Banking options: Bank Wire Transfer, EcoPayz, MasterCard, Neteller, Paysafe Card, instaDebit, Visa, Entropay, EPS, Euteller, Bancontact/Mister Cash, Fast Bank Transfer, Trustly, Skrill, Wire Transfer, Skrill 1-Tap, Zimpler, Klarna Instant Bank Transfer, MuchBetter, Rapid Transfer, PayPal, Interac, AstroPay Card, CashtoCode, GiroPay

Mobile options: Over 800 mobile games

Can’t seem to find a well-rounded betting website to play some of your favorite casino titles or bet on sports? If so, look no further because Luckster Casino might just have what you need! Luckster Casino is a betting website established fairly recently, in 2022, and has everything you need for a smooth gambling experience. ... READ FULL REVIEW

- 1X2gaming

- Ainsworth

- Aristocrat

- Bally

- Barcrest

- Betsoft

- Big Time Gaming

- Blueprint

- Booongo

- Cadillac Jack

- Elk Studios

- Evolution Gaming

- Ezugi

- GameArt

- Habanero

- High 5 Games

- IGT

- Inspired Gaming

- Irondog

- iSoftBet

- Lightning Box

- Magnet Gaming

- Merkur

- Microgaming

- NeoGames

- NetEnt

- NextGen

- Nolimit City

- NYX

- Old Skool Studios

- Oryx

- Pariplay

- Play 'N Go

- Playtech

- Pragmatic Play

- Quick Spin

- Quickfire

- Rabcat

- Realistic

- Red Rake

- Scientific

- SG Interactive

- Skillzzgaming

- SYNOT

- Thunderkick

- Tom Horn Gaming

- Triple Edge Studios

- WMS

- Huge Live Casino

- Many payment options

- Integrated Sportsbook

- No live chat

Bonus Terms

New customers only. Opt In required. £/€10 min stake on Casino slots within 30 days of registration. Max bonus 200 Free Spins on selected games credited within 48 hours. Free Spins expire after 7 days. iOS app restrictions may apply. Email/SMS validation may apply. Not available in NI. Full T&Cs apply.

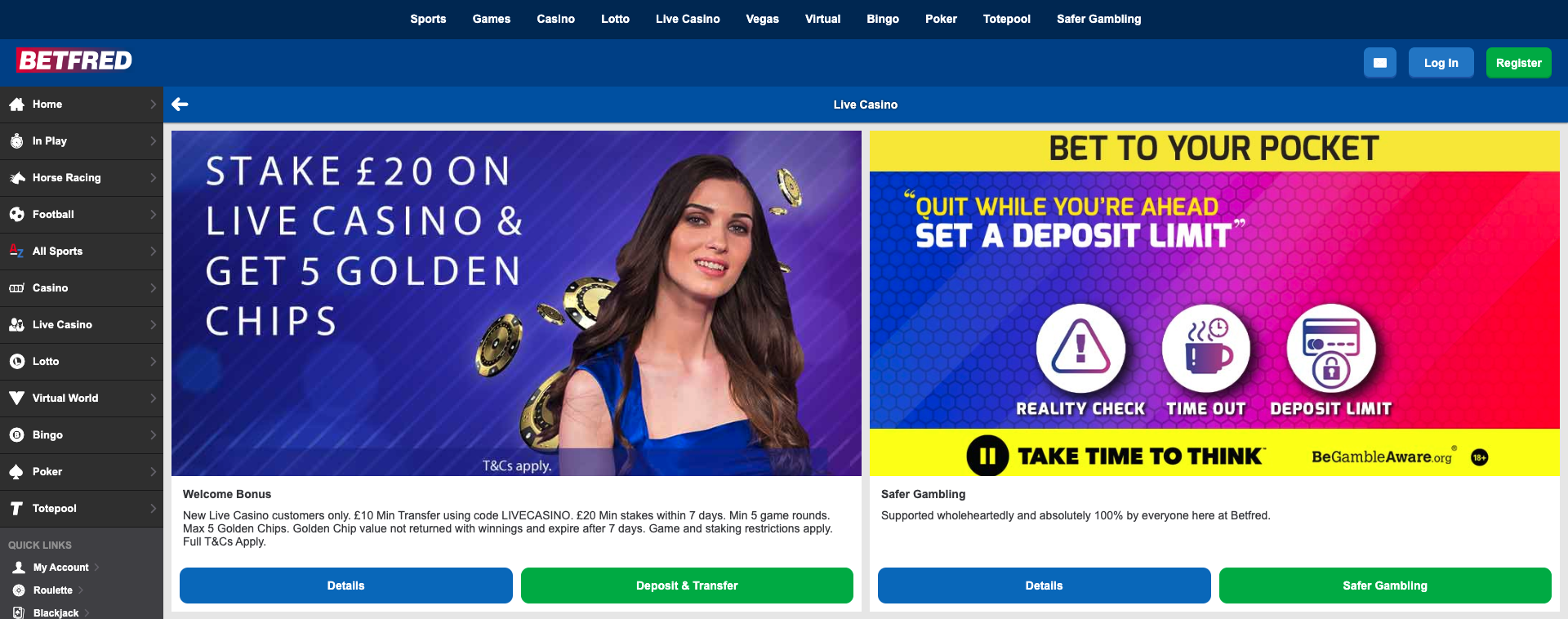

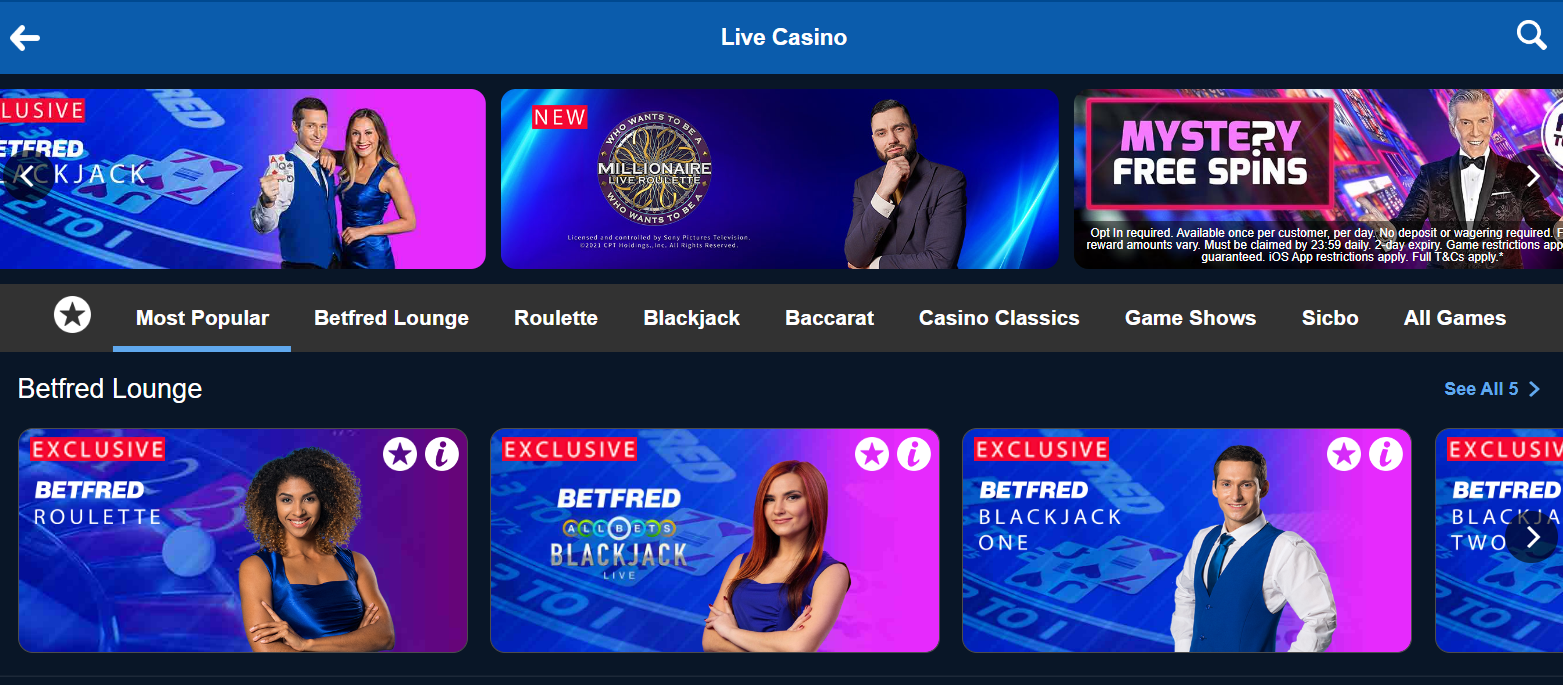

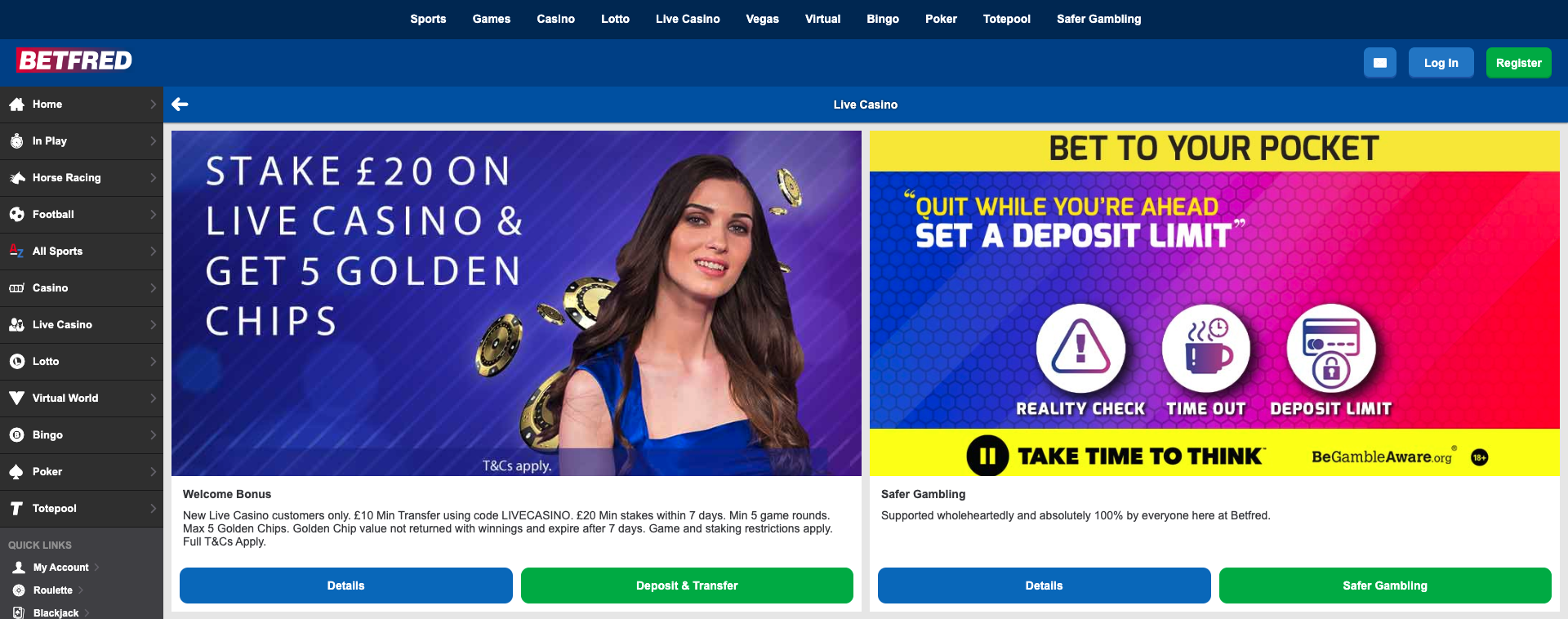

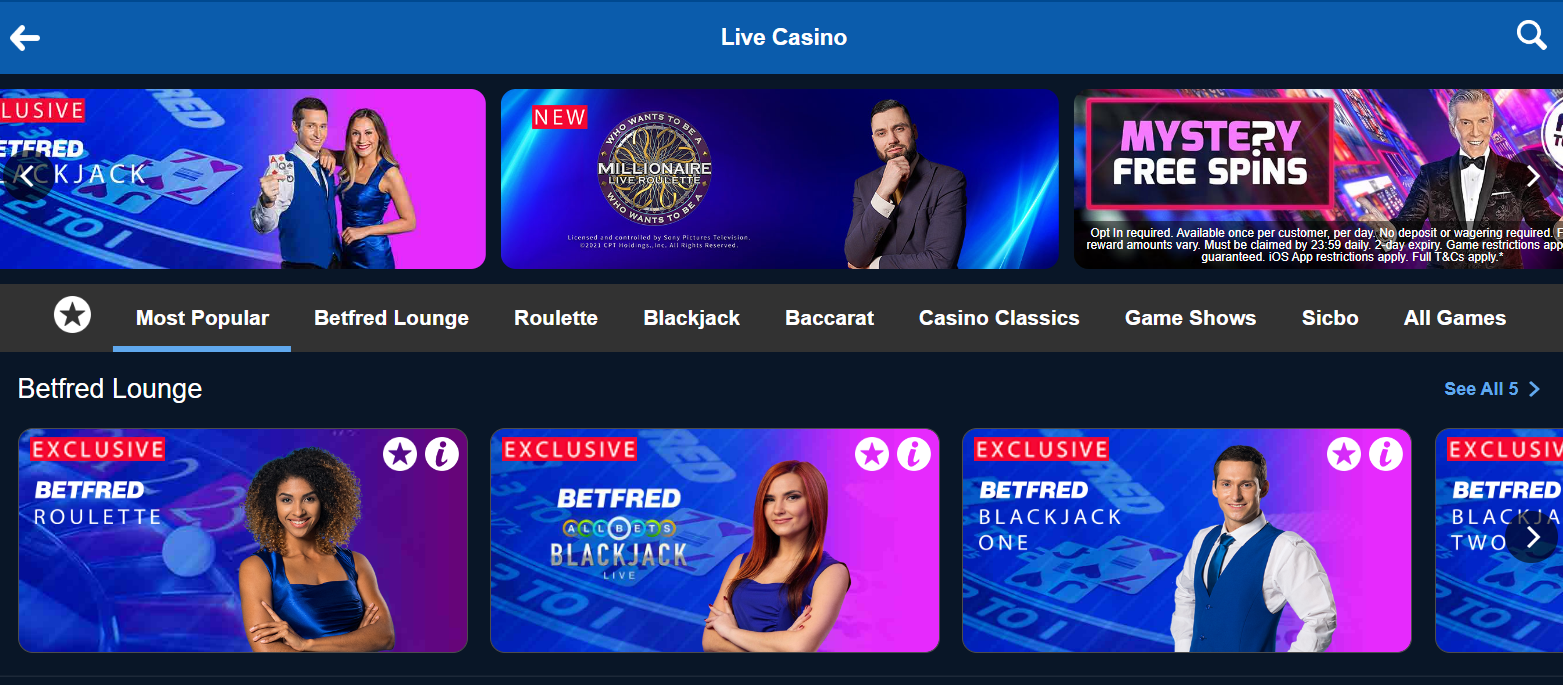

*exclusive* Stake £10 get 200 free spinsOnline Casino: Betfred

Established: 2008

Company: Petfre (Gibraltar) Limited

UK Gambling Licence link: 39544

Platform: Playtech

Banking options: Mastercard, Visa, Neteller, PayPal, Skrill, Paysafecard, Bank transfers.

Mobile options: mobile app and mobile website version

Established in the late 1960s, Betfred is one of the largest, most well-known, and oldest UK sports betting brands. Today, however, the company doesn’t just cater to sports fans. Over the years, it has evolved into a whole chain of family sites that offer different UK online casino games, lotto, bingo, and more. But is ... READ FULL REVIEW

- Ash Gaming

- Casino Technology

- Eyecon

- GECO Gaming

- IGT

- Microgaming

- NetEnt

- Playtech

- Psiclone Games

- Rarestone Gaming

- Skywind Group

- Sunfox Games

- Yggdrasil

- Much more just a casino

- Huge Selection of Slots

- Continuous Promotions

- Big Prizes

- Too many options

Bonus Terms

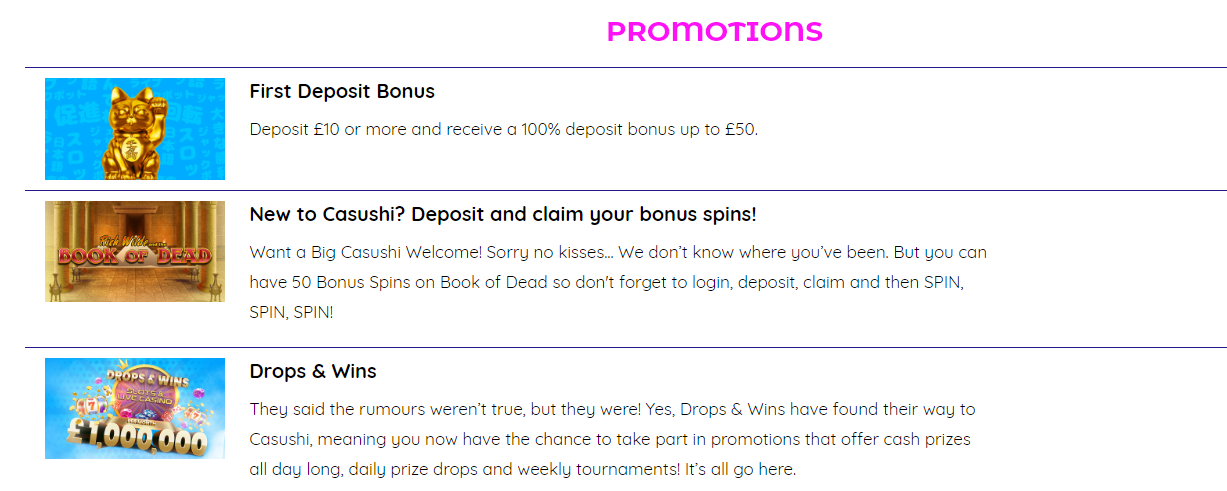

18+. New players only. 100% bonus on first deposit up to £50 & 50 Bonus Spins (30 spins on day 1, 10 on day 2, 10 on day 3) for Book of Dead slot only. Min first deposit of £20. Max bonus £50. Max bonus bet £5. Max bonus cash-out £250. 40x wagering requirements. Bonus expiry 30 days. Bonus spins expiry 2 days. Game restrictions apply. Further Terms Apply. Please gamble responsibly. Begambleaware.org. #AD

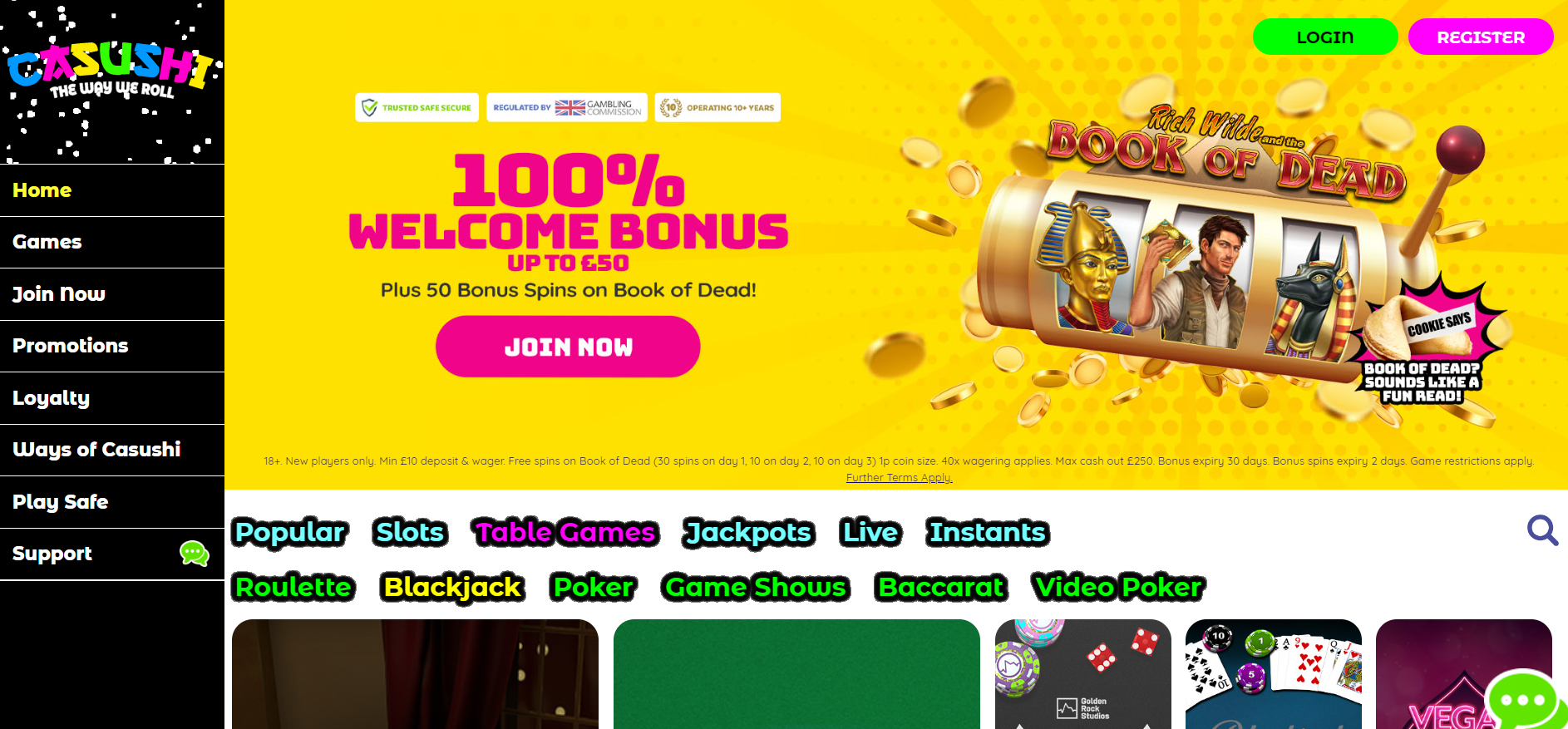

100% up to £100 + 50 spinsOnline Casino: Casushi

Established: 2020

Company: Dazzletag Entertainment Ltd

UK Gambling Licence link: 39358

Platform: NetEnt & Microgaming

Banking options: MasterCard, Visa, Skrill, Neteller, Trustly, Paysafecard, PayPal & Maestro

Mobile options: The website is optimized for all mobile devices

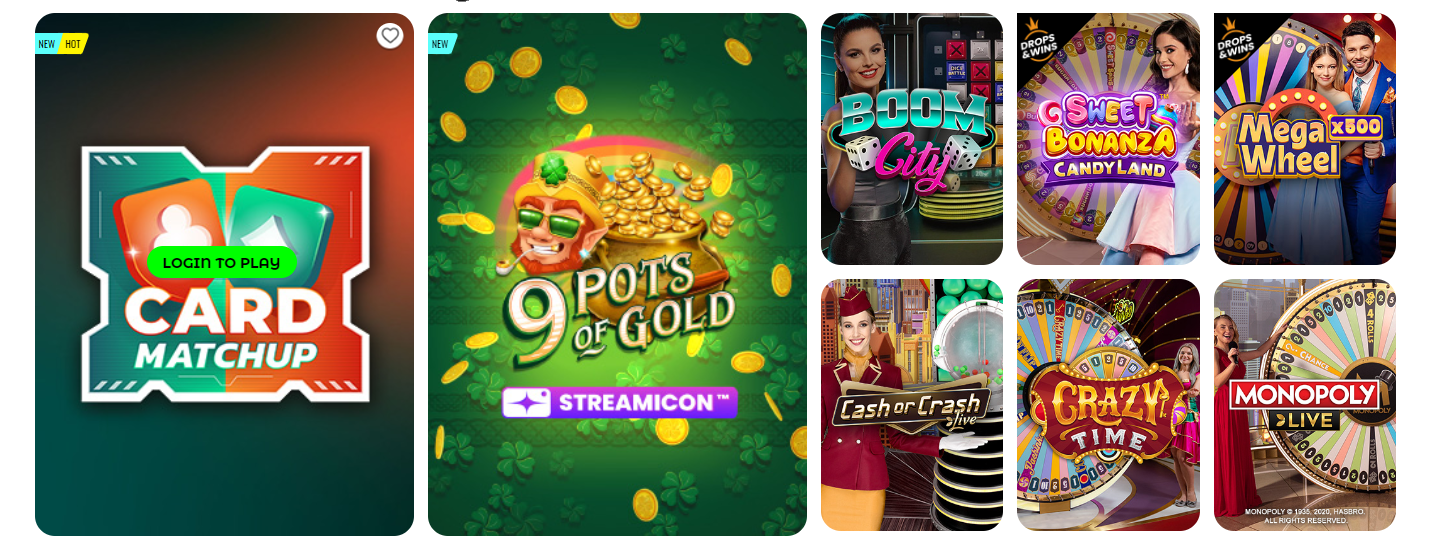

Finding a decent gambling website nowadays is hard, especially when you consider how many are in the industry. But have you heard of Casushi Casino? Casushi is an online casino inspired by Japanese culture with a colorful website that stands out from the rest of the competition. This engaging casino has many high-quality games, reliable ... READ FULL REVIEW

- 1X2gaming

- Big Time Gaming

- Elk Studios

- Evolution Gaming

- Fantasma Games

- Gamevy

- Golden Rock Studios

- NetEnt

- Red Tiger

- Huge Variety of Slot Titles

- Sushi Train Loyalty Club

- Helpful FAQ Section

- Great Game Categorization

- Mobile-Friendly Website

- Lack of Poker Games

- Small Welcome Bonus

Pub Casino

- Fast payment options.

- SSL Data Encryption Security

- Various responsible gambling options available

Bonus Terms

Welcome bonus for new players only | Maximum bonus is 100% up to £100 | Min. deposit is £10 | No max cash out | Wagering is 45x bonus | Maximum bet with an active bonus is £5 Eligibility is restricted for suspected abuse | Skrill & Neteller deposits excluded for welcome bonus | Cashback when offered, applies to deposits where no bonus is included | Cashback is cash with no restrictions |

100% up to £100If you’re looking for an online gambling establishment that provides not just the standard fare of table games and live dealer options but also some of the top slot machines in the industry, you should check out Pub Casino! Pub Casino offers a wide selection of games, great signup bonuses, prompt payments, helpful customer service, ... READ FULL REVIEW

- Big Time Gaming

- Blueprint

- Elk Studios

- Evolution Gaming

- Eyecon

- Hacksaw Gaming

- Inspired

- Microgaming

- NetEnt

- Nolimit City

- Novomatic

- Play 'N Go

- Pragmatic Play

- Red Tiger

- Slingo

- Thuderkick

- Huge Slot Library

- Fast Payout Options

- A Big Selection of Slingo Games

- Great Customer Support

- User-Friendly Interface

- Inaccessible in Some Areas

- Accepts Only British Pound

- Welcome Bonus is Limited to UK Players

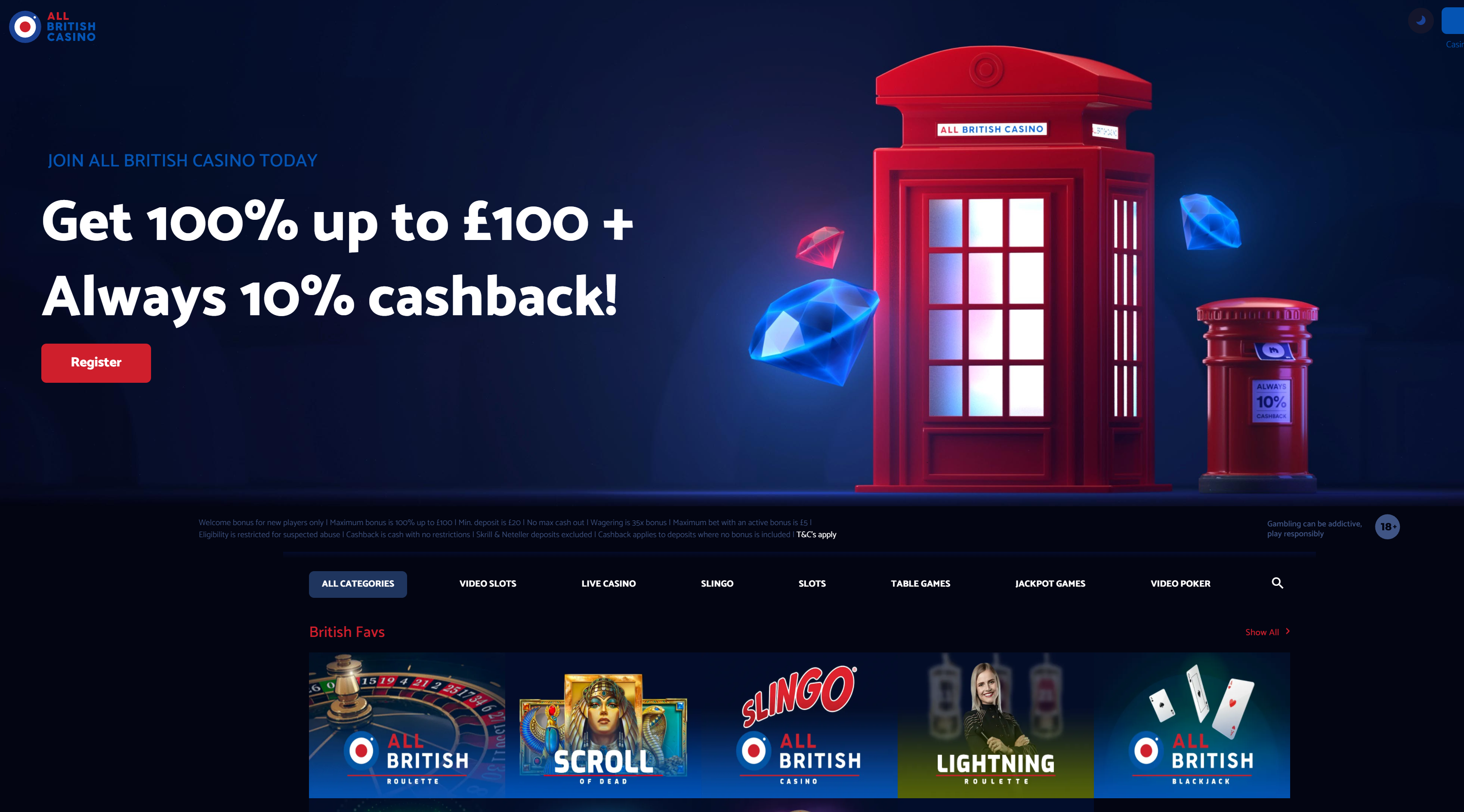

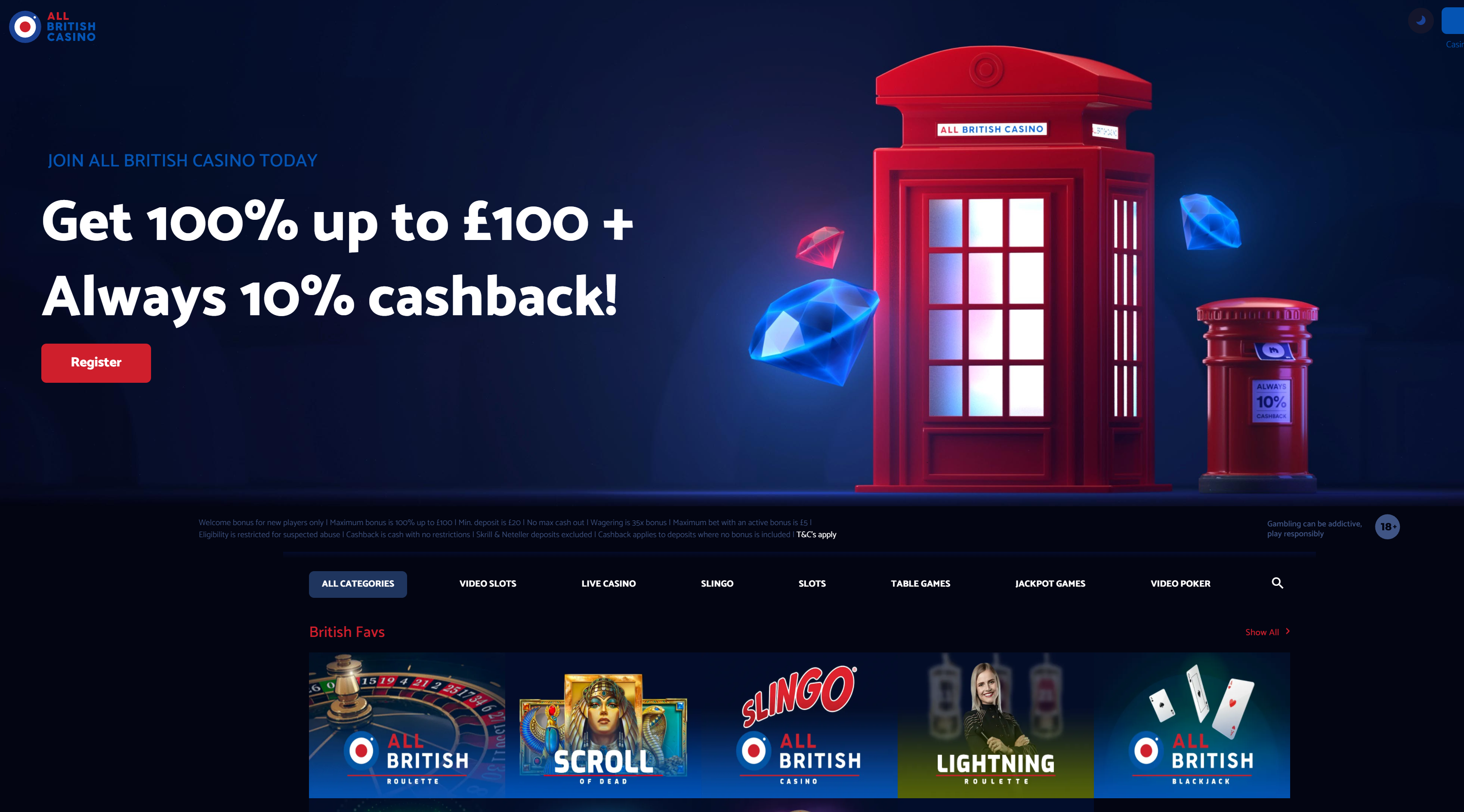

All British Casino

- Permanent 10% cashback

- Over 70 Live Dealer games

- Best Casino of 2021 (Casinomeister)

Bonus Terms

New customers only, 10 free spins on registration (max withdraw is £100) | 100 free spins after first deposit | Min deposit £20 | Maximum bonus is 100% up to £100 Wagering is 35x bonus | No max cash out cashback is cash with no restrictions | Bonus excluded for players that deposit with Skrill or Neteller | Gambling can be addictive | Play responsibly | 18+

100%/£100 + 10% Cashback + EXCLUSIVE 110 Free SpinsOnline Casino: All British Casino

Established: 2013

Company: L&L Europe Ltd

UK Gambling Licence link: 38758

Platform: L&L

Banking options: Apple pay, Bankwire, Boku, MasterCard, Neteller, Paysafe Card, Skrill, Trustly, Visa Debit

Mobile options: Over 700 mobile games

Review: All British Casino Full Review

*Exclusive* online-casinos.co.uk offer: yes.

All British Casino Overview Patriotism, nationalism, whatever… we can take it or leave it personally. That’s not the case at All British Casino, a site founded in 2013 that plays very heavily – as you might have guessed – on British symbolism and identity. The badge is an RAF-style roundel, with a mural of ... READ FULL REVIEW

- Amatic

- Blueprint

- Enabled

- Evolution Gaming

- IGT

- Microgaming

- Multilotto

- NetEnt

- Novomatic

- NYX

- Play 'N Go

- Pragmatic Play

- Stakelogic

- Search by Provider feature

- Amazing cashback offer

- From legendary casino group L&L

- No scratchcards

- No crypto currency accepted

- Neteller excluded from bonus

Bonus Terms

First deposit only. Min deposit £10. 100% Bonus Match on 1st deposit, max £100 bonus; 100 bonus spins on Starburst. 40x wagering(dep+bonus). 40x on spins, 4x conversion, bonus valid on selected slots. Full T&Cs apply.

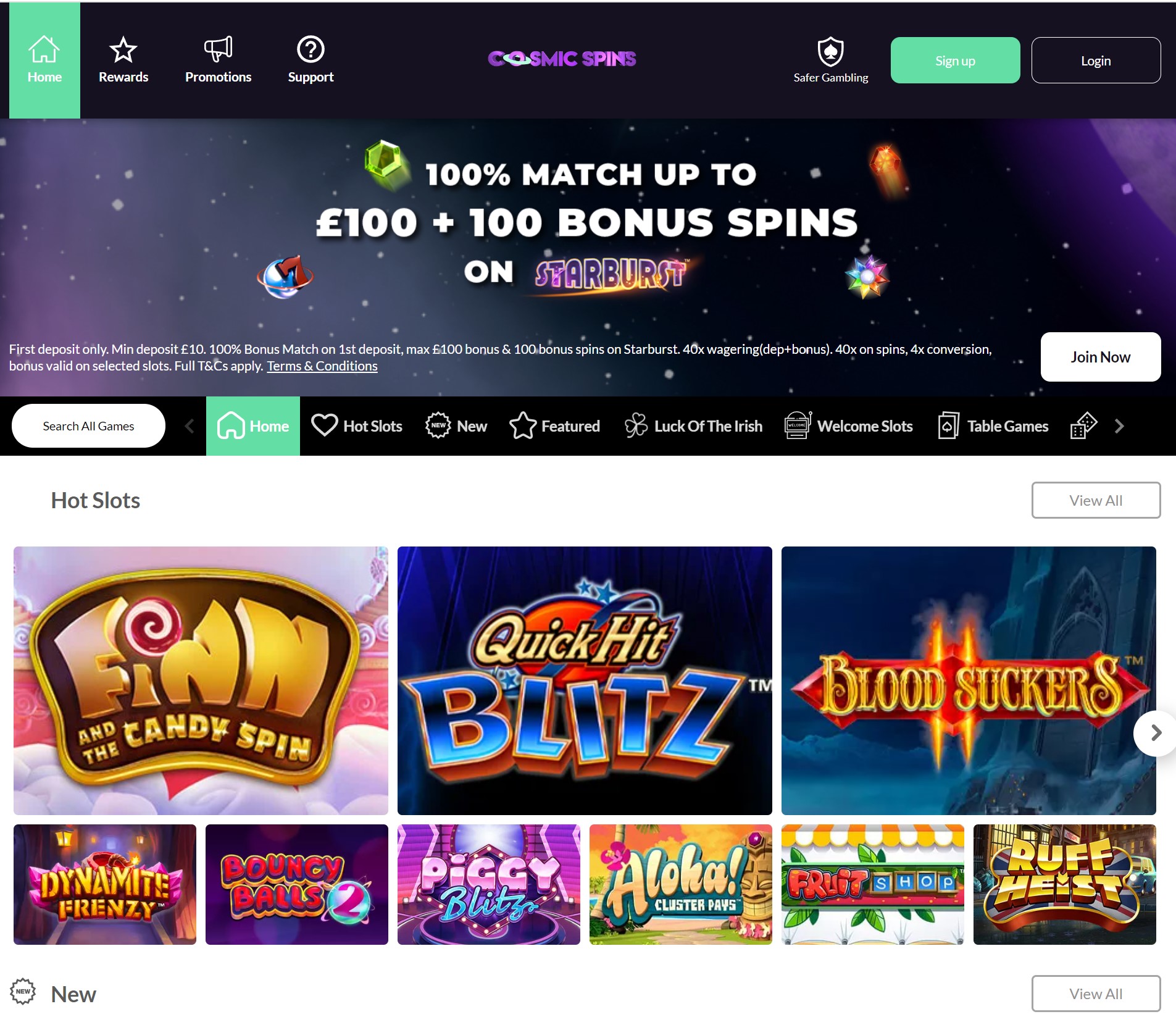

100% up to £100 + 100 spins on StarburstOnline Casino: Cosmic Spins

Established: 2019

Company: Grace Media

UK Gambling Licence link: 41645

Platform: Grace Media / Markor

Banking options: Visa, MasterCard, Paysafe Card, PayPal, Trustly, Debit Card

Mobile options: 827 mobile games

Cosmic Spins Casino Review Fancy taking “an out-of-this-world journey” with the potential to stumble across astronomical wins? Make sure your wallet is handy and go visit Cosmic Spins, a 2019 online casino powered by UK-based Betable Ltd, regulated by the UK Gambling Commission, and currently accepting only UK residents. consistently executed ... READ FULL REVIEW

- Alchemy Gaming

- All41 Studios

- Aurum Signature

- Big Time Gaming

- Blueprint

- Buck Stakes

- Crazy Tooth Studio

- Evolution Gaming

- Eyecon

- Fortune Factory Studios

- Foxium

- Gacha Studios

- Gamevy

- Gold Coin Studios

- Golden Rock Studios

- Gong Gaming

- Habanero

- Hacksaw Gaming

- Half Pixel Studios

- Infinity Dragon

- JustForTheWin

- Leander

- Live 5 Gaming

- Markortech

- Matrix Studios

- Merkur

- Microgaming

- Neko Games

- Nektan

- Neon Valley Studios

- NetEnt

- Northern Lights

- NYX

- Pear Fiction Gaming

- Pragmatic Play

- Pulse 8

- Rabcat

- Realistci Games

- Red Tiger

- Rising Entertainment

- Rocksalt Interactive

- Slingshot

- Slot Factory

- Snowborn

- Spin Play Games

- Stakelogic

- Stormcraft

- Switch Studios

- Triple Edge Studios

- Yggdrasil

- No max withdrawals

- Many safety features

- New games weekly

- No live blackjack

Luckyme Slots

- Daily promotions and tournaments

- Supports variety of payment methods

- Diverse game catalogue

Bonus Terms

First Deposit Only. Min. deposit: £10. Game: Spina Colada, Spin Value: £0.10. WR 60x free spin winnings amount (only Slots count) within 30 days. Max bet is 10% (min £0.10) of the free spin winnings amount or £5 (lowest amount applies). Free Spins must be used before deposited funds. Bonus Policy applies. Game subject to availability and/or your geographical location. We reserve the right to cancel this promotion at any time for any reason.

100 Free SpinsOnline Casino: Luckyme Slots

Established: 2018

Company: SkillsOnNet Ltd

UK Gambling License: 319358

Banking options: Visa, Mastercard, Paysafecard, Paypal, Trustly, Skrill, ecoPayz, SOFORT, Bank Transfers, Apple Pay

Mobile options: Mobile version available

Review: Luckyme Slots Casino

If you want to try your hand at slot machines, table games, and even live dealers, go no further than LuckyMe Slots Casino. LuckyMe Slots Casino has everything a gambler would want: various games, plenty of generous prizes, credibility, and fair gameplay, among other things! If that isn’t enough to get you interested in this ... READ FULL REVIEW

- Evolution Gaming

- IGT

- Microgaming

- NetEnt

- Play 'N Go

- Pragmatic Play

- Red Tiger

- Thunderkick

- Yggdrasil

- Simple Signup Process

- Exclusive Selection of Slots

- Variety of Games Offered

- Helpful Customer Support

- Lots of Progressive Jackpots

- Inaccessible in Some Countries

- Limited Payment Methods

- No Sports Betting Available

Bonus Terms

Welcome package includes 3 deposit bonuses as follows: First Deposit: 100% up to £50 + 20 Spins on Starburst *Min. Deposit £10 Second Deposit: 50% up to £75 *Min. Deposit £20 Third Deposit: 50% up to £75 *Min. Deposit £20 After first deposit made, customers will get + 20 Spin for the next 4 days: 1st day after First Deposit: 20 Spins of Finn and the Swirly Spin 2nd day after First Deposit: 20 Spins of Book of Dead 3rd day after First Deposit: 20 Spins of VIP Black 4th day after First Deposit: 20 Spins of Aloha! Cluster Pays Winnings won with spins that require deposit, have to be wagered 35x. Bonuses that require deposit, have to be wagered 35x. This offer is available to players residing in United Kingdom only.

100% up to £50 + 100 spinsOnline Casino: Mr Play

Established: 2017

Company: Marketplay Limited

UK Gambling Licence link: 39483

Platform: Aspire Global

Banking options: Bank Wire Transfer, EcoPayz, MasterCard, Neteller, Paysafe Card, instaDebit, Visa, Entropay, EPS, Euteller, Bancontact/Mister Cash, Fast Bank Transfer, Trustly, Skrill, Wire Transfer, Skrill 1-Tap, Zimpler, Klarna Instant Bank Transfer, MuchBetter, Rapid Transfer, PayPal, Interac, AstroPay Card, CashtoCode, GiroPay

Mobile options: Over 1200 mobile games

Who is Mr Play? That’s a bit of a mystery, or so the team from Marketplay LTD, who own the brand, would like you to believe. The site is branded with a moustache, used as a disguise behind which hide Mr Play, usually in the guise of an attractive young woman. We can unveil some ... READ FULL REVIEW

- 1X2gaming

- Ainsworth

- Aristocrat

- Bally

- Barcrest

- Betsoft

- Big Time Gaming

- Blueprint

- Booongo

- Cadillac Jack

- Elk Studios

- Evolution Gaming

- Ezugi

- GameArt

- Habanero

- High 5 Games

- IGT

- Inspired Gaming

- Irondog

- iSoftBet

- Lightning Box

- Magnet Gaming

- Microgaming

- NeoGames

- NetEnt

- NextGen

- Nolimit City

- NYX

- Old Skool Studios

- Oryx

- Pariplay

- Play 'N Go

- Playtech

- Pragmatic Play

- Quick Spin

- Quickfire

- Rabcat

- Realistic Games

- Red Rake

- Scientific

- SG Digital

- Skillzzgaming

- SYNOT

- Thunderkick

- Tom Horn Gaming

- Triple Edge Studios

- WMS

- Flagship Aspire Brand

- Instant Bank Payments

- Millions in Bonus Prizes

- Similar to sister casinos

Bonus Terms

11 Welcome Spins Wager-free and 100% up to £200 on your 1st deposit. Min. deposit £10. 7 days to activate the spins. Bonus spins expire 24 hours after activation. Activate the Welcome Bonus within thirty (30) calendar days under the 'My Bonuses’ section. 100% bonus up to £ 200 will be paid out in 10% increments to Main Account balance. 35x wagering. Play Responsibly.

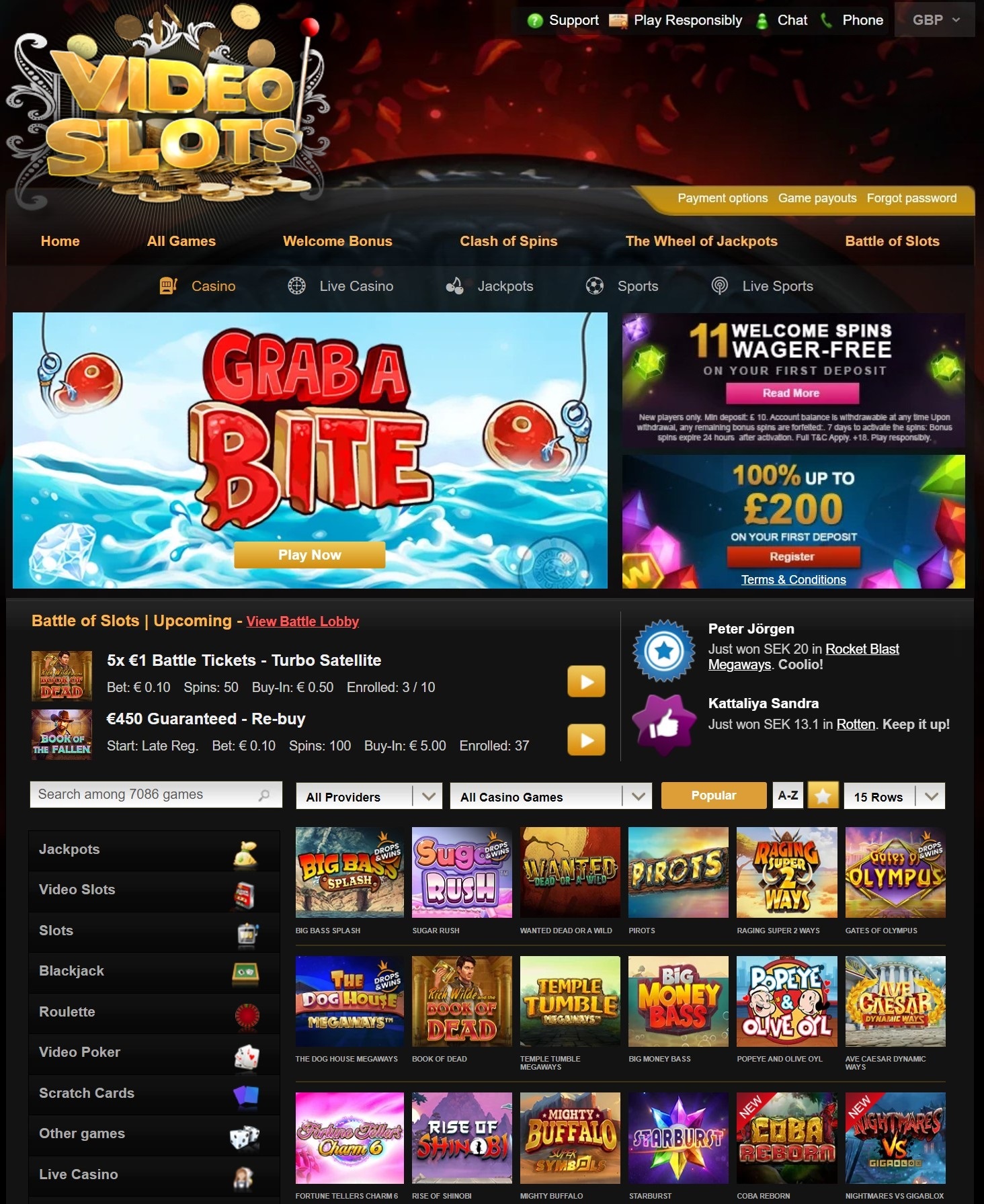

100% up to £200 + 11 welcome spins + up to 4200 Battle Slot spinsOnline Casino: Videoslots

Established: 2011

Company: Videoslots Ltd.

UK Gambling License: 39380

Banking options: Visa, Mastercard, Paypal, Trustly, Skrill, Bank Transfers, Apple Pay, CashToCode, Ecopayz, Euteller, Flexepin, Giropay, InstaDebit, Interac, Klarna, Paysafecard, Rapid Transfer, Siru Mobile, SMS Voucher, Vega Wallet, Zimpler

Mobile options: Mobile Website

Videoslots Casino Overview A Maltese-based casino with Swedish roots, Videoslots Casino is a decent find. It hasn’t been around very long, winning Casinomeister’s “Best New Casino” award 2014 (Casinomeister is a rival information site, but even we have to admit that’s a decent endorsement). According to their website, they host games from all of ... READ FULL REVIEW

- 1X2gaming

- 2by2 Gaming

- 4 The Player

- AGS

- Ainsworth

- Alchemy Gaming

- All41 Studios

- Amatic

- Amaya

- Aristocrat and Leander

- Ash Gaming

- Asylum Labs

- Aurum Signature

- Authentic

- Bally

- Bally Wulff

- Barcrest

- BB Games

- Bet Digital

- Betsense

- Betsoft

- Big Time Gaming

- Bla Studios

- Black Pudding

- Blueprint

- Booming Games

- Booongo

- BTG

- Buck Stakes

- Bulletproof Gaming

- BWIN

- Cadillac Jack

- Casino Technology

- Cayetano

- Chance Interactive

- Colossus Bets

- Concept Gaming

- Core Gaming Cayetano

- Crazy Tooth Studio

- Cryptologic

- Dice Lab

- Dragonfish

- Dream Tech

- DTech Gaming

- DWG

- Edict

- Electracade

- Electric Elephant

- Elk Studios

- Enabled

- Endemol

- EuroStar Studios

- Evolution Gaming

- Eyecon

- Ezugi

- Fantasma Games

- Felt Games

- Fortune Factory Studios

- Four Leaf Gaming

- Foxium

- FugaGaming

- Gacha Studios

- GameArt

- Gameburger

- Games Global

- Games inc

- Games Lab

- GamesOS

- GamesWarehouse

- Gamesys

- Gamevy

- Gaming Realms

- Gaming1

- Gamomat

- GECO Gaming

- Genesis

- Giveme

- Gold Coin Studios

- Golden Hero

- Golden Rock Studios

- Gong Gaming

- Green Jade

- Green Tube

- Habanero

- Hacksaw Gaming

- Half Pixel Studios

- Happy Tiger Games

- High 5 Games

- High Games

- Hurricane Games

- Iforium

- IGT

- InBet Games

- Infinity Dragon

- Inspired Gaming

- Instant Win Gaming

- Irondog

- iSoftBet

- Jade Rabbit Studios

- JustForTheWin

- Kalamba

- Leander

- Light & Wonder

- Lightning Box

- Live 5 Gaming

- Lucksome Studios

- Magic Dreams

- Magnet Gaming

- MahiGaming

- Max Win

- Merkur

- Meta Games Universal

- MGA

- MGS

- Microgaming

- Microprose

- Multilotto

- Mutual

- Nailed It Games

- NeoGames

- Neon Valley Studios

- NetEnt

- NextGen

- Nolimit City

- Northern Lights

- Novomatic

- NYX

- Old Skool Studios

- OMI Gaming

- Openbet

- Oros

- Oryx

- Pariplay

- Pear Fiction Gaming

- Peter & Sons

- PG Soft

- Pirates Gold Studio

- Play 'N Go

- Playko

- Playson

- Playtech

- Playzido

- Pragmatic Play

- Print Studios

- Probability Jones

- Psiclone Games

- Pulse 8

- Push Gaming

- Quick Spin

- Quickfire

- Rabcat

- Random Logic

- Rarestone Gaming

- Realistic Games

- Red 7

- Red Rake

- Red Tiger

- Reel NRG Gaming

- Reel Play

- Reel Time Gaming

- Reflex Gaming

- Relax Gaming

- Revolver Gaming

- Ruby Play

- Sapphire Gaming

- Scientific

- Seven Deuce

- SG Digital

- SG Interactive

- Shufflemaster

- Side City

- Sigma Gaming

- Silverback

- Skillzzgaming

- Skywind

- Skywind Group

- Slingo

- Slingshot

- Snowborn

- Spearhead Studios

- SpielDev

- Spike Games

- Spin Play Games

- Spinmatic

- Spinomenol

- Spribe Gaming

- Stakelogic

- STHLM Gaming

- Storm Gaming

- Stormcraft Studios

- Sunfox

- Sunfox Games

- Switch Studios

- SYNOT

- The Games Company

- Thunderkick

- Tom Horn Gaming

- Touchstone Games

- Triple Edge Studios

- Triple Profits Games

- tx2 Network

- Virtuefusion

- WagerWorks

- Wazdan

- WGS Technology

- Wild Game Reserve

- Wild Streak

- Williams

- WMS

- XPG

- Yggdrasil

- Yolo Play

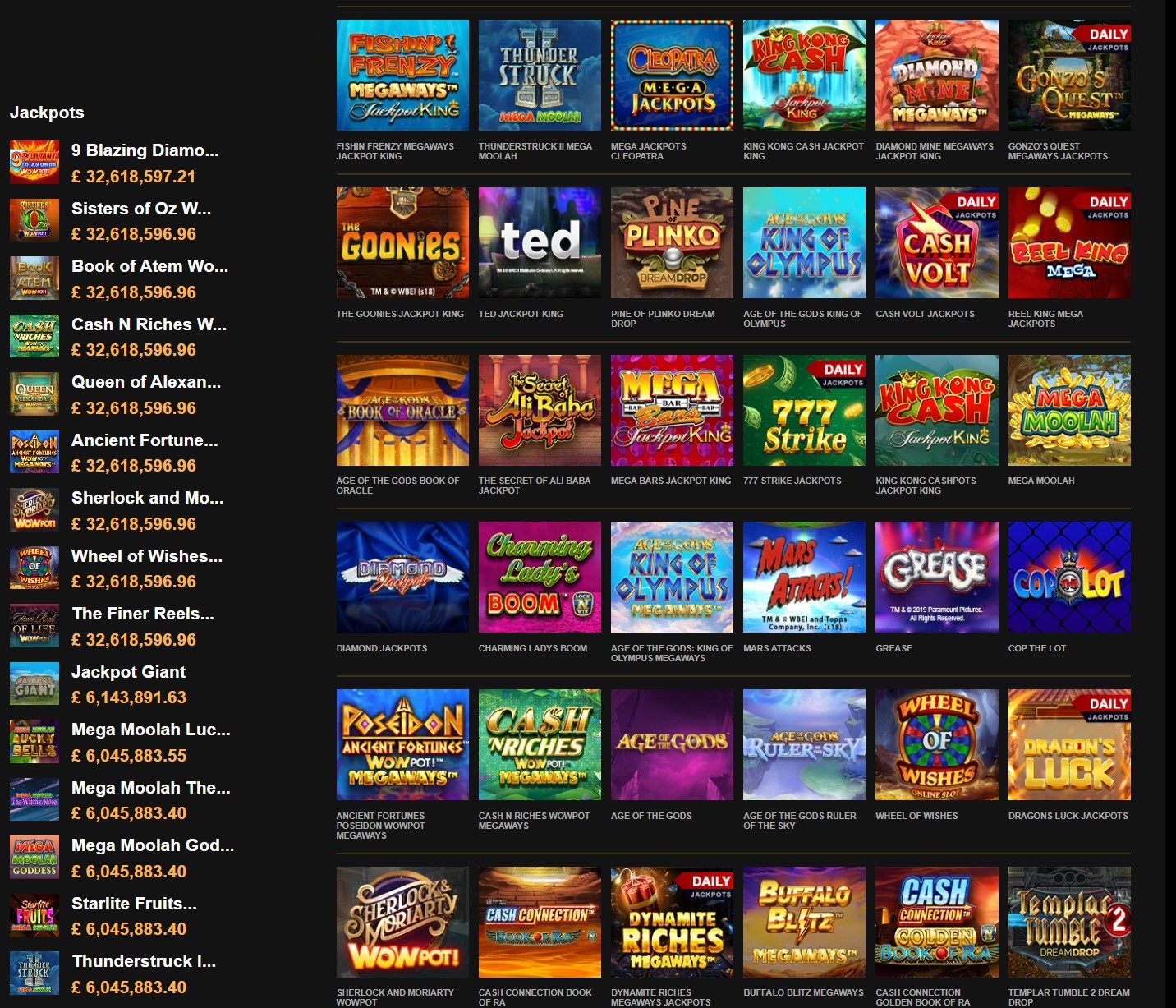

- £100m's in Jackpots

- The Ultimate Online Casino

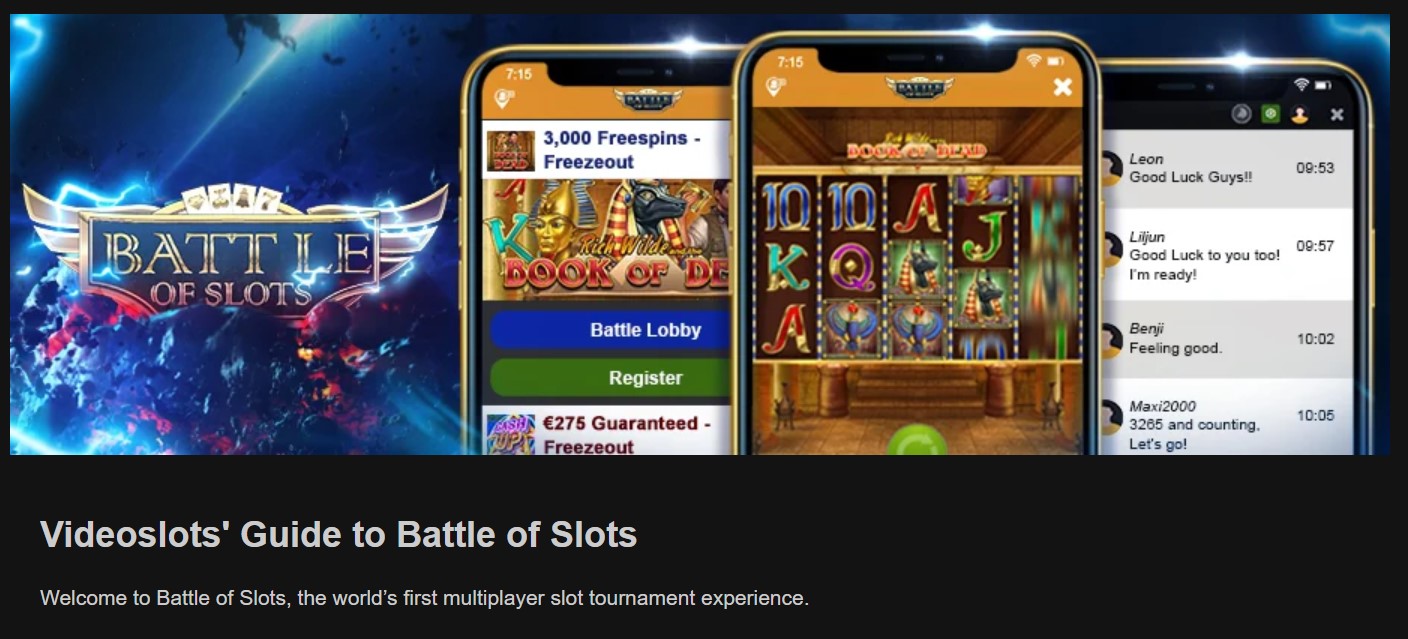

- Wheel of Jackpots

- Clash of Spins

- Integrated Sportsbook

- No Bingo

- Old Fashioned Design

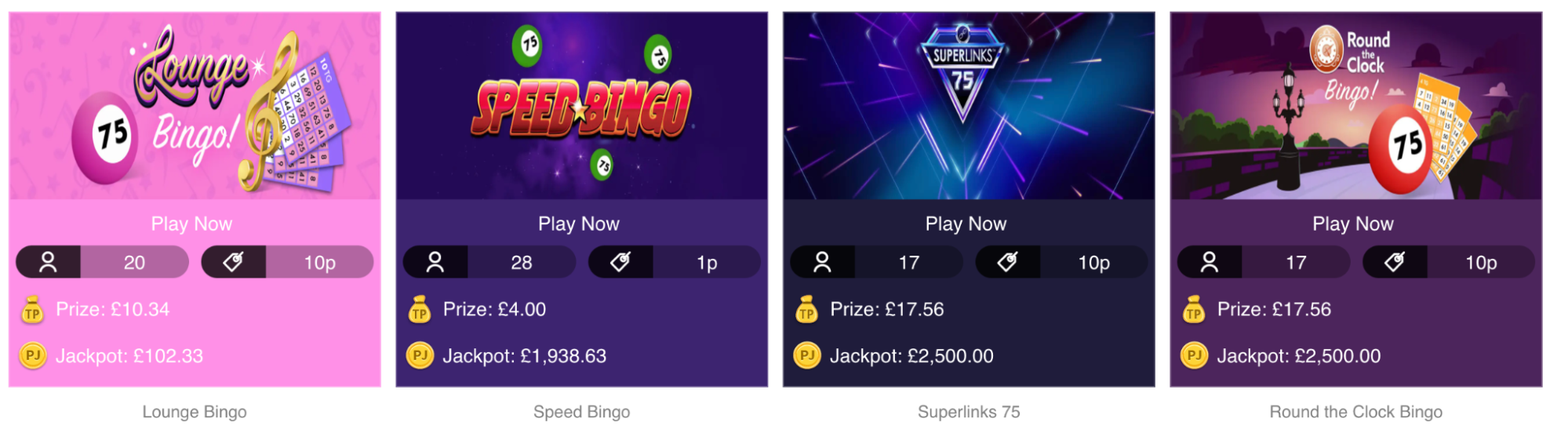

Jackpotjoy

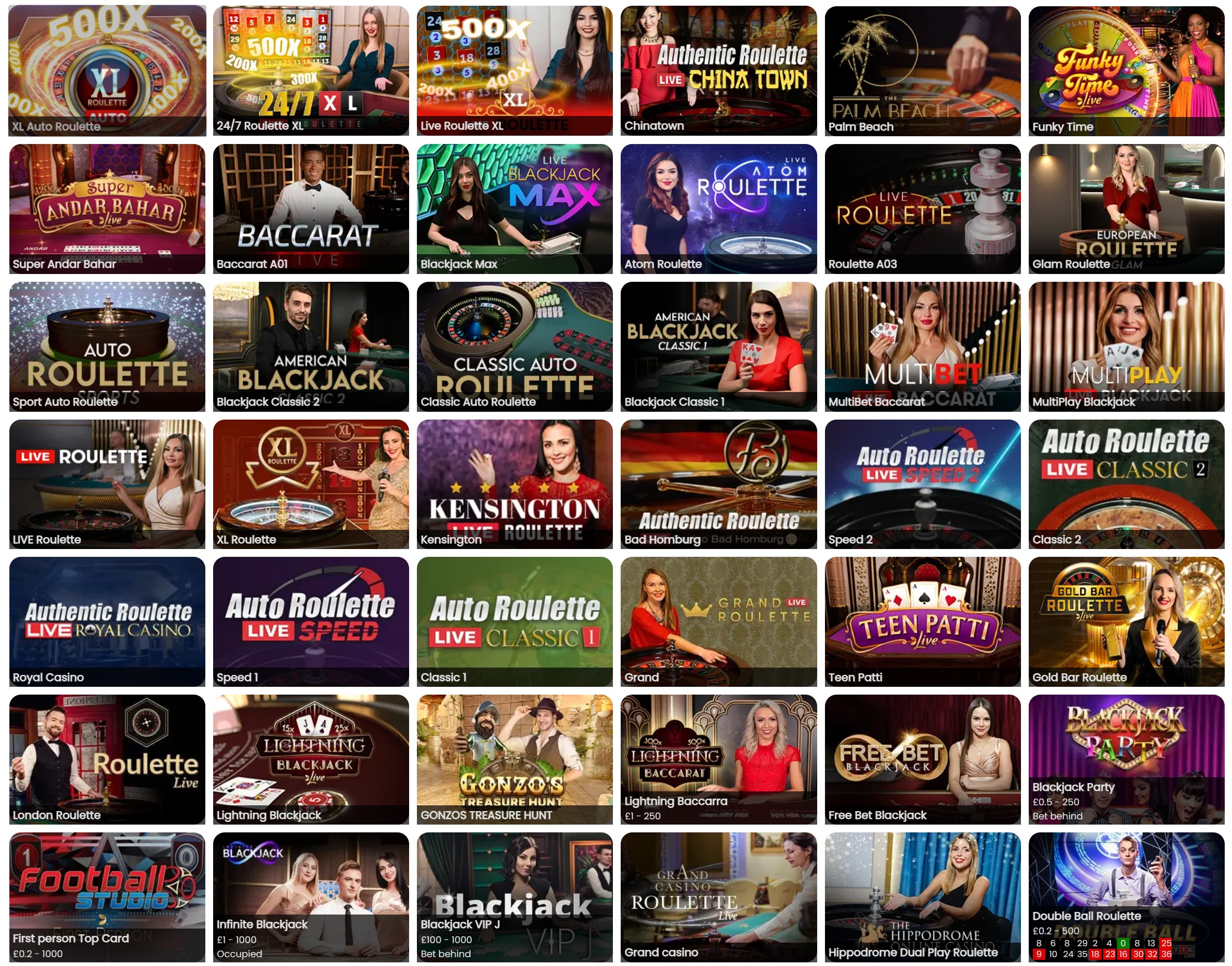

- Diverse selection of online blackjack and roulette games

- Quick withdrawal process

- Various promotions monthly

Bonus Terms

If you are a new member, you will be eligible to receive either: a) 30 free spins (1p coin size, maximum lines) for the game Double Bubble (“Free Spins”); or b) 50 free bingo tickets (“Free Bingo Tickets”) on applicable games (see section 5(b) below).

30 Free SpinsOnline Casino: Jackpotjoy Casino

Established: 2022

Company: Gamesys Operations Limited

UK Gambling License: 38905

Banking options: Visa, Mastercard, Skrill, Bank Transfers, Apple Pay, Paypal, Neteller

Mobile options: Mobile App Available

Review: Jackpotjoy Casino

If you are looking for a casino where you can play all of your favorite games, you have come to the right place. How familiar are you with Jackpotjoy Casino? When it comes to games, bonuses, promotions, customer service, mobile compatibility, and more, Jackpotjoy is hard to beat. It’s got everything a passionate gambler could ... READ FULL REVIEW

- Barcrest

- Big Time Gaming

- Blueprint

- Evolution Gaming

- IGT

- Merkur

- Microgaming

- NetEnt

- Novomatic

- Red Tiger

- Reel NRG Gaming

- Reel Time Gaming

- SG Digital

- WMS

- Slot Game Selection

- Fast Banking Times

- Variety of Slingo Games

- An Easy-to-Navigate Layout

- Trustworthy Customer Service

- Country Restrictions

- Limited Payment Options

- Fewer Games to Choose From

Bonus Terms

Terms and Conditions apply. New players only. 18+. Min deposit £10. Wagering requirement apply 35x. Offer valid for 72hr. 100 spins includes 3 deposit. First Deposit: 100% up to £50 + 20 Spins on Starburst *Min. Deposit £10 Second Deposit: 50% up to £75 *Min. Deposit £20 Third Deposit: 50% up to £75 *Min. Deposit £20 After the first deposit made, customers will get + 20 Spin for the next 4 days: 1st day after First Deposit: 20 Spins of Finn and the Swirly Spin 2nd day after First Deposit: 20 Spins of Book of Dead 3rd day after First Deposit: 20 Spins of VIP Black 4th day after First Deposit: 20 Spins of Aloha! Cluster Pays Winnings won with spins that require a deposit, have to be wagered 35x.

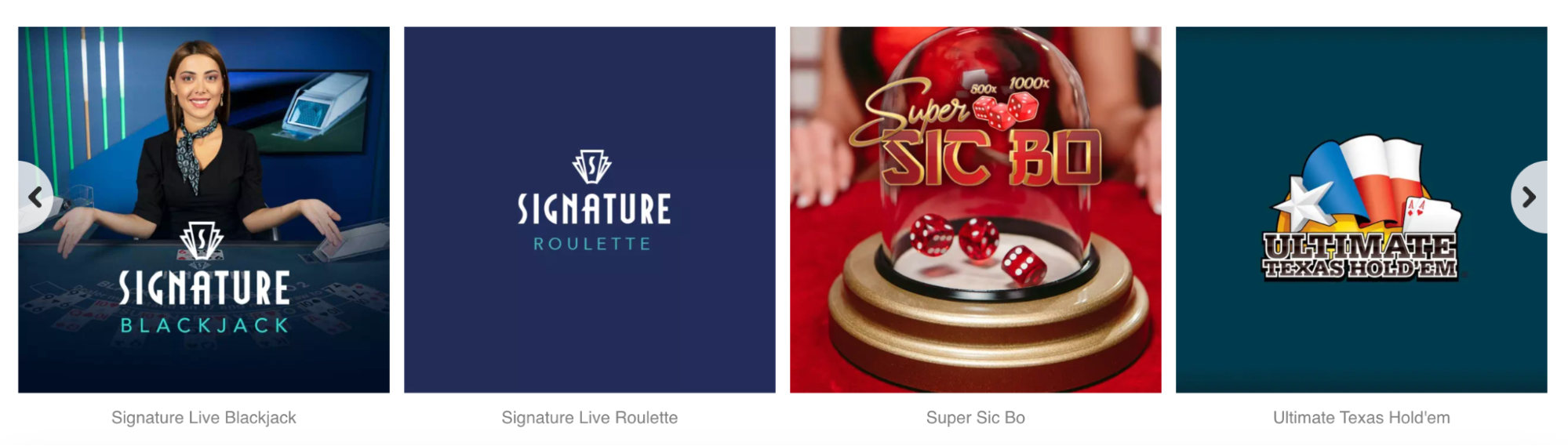

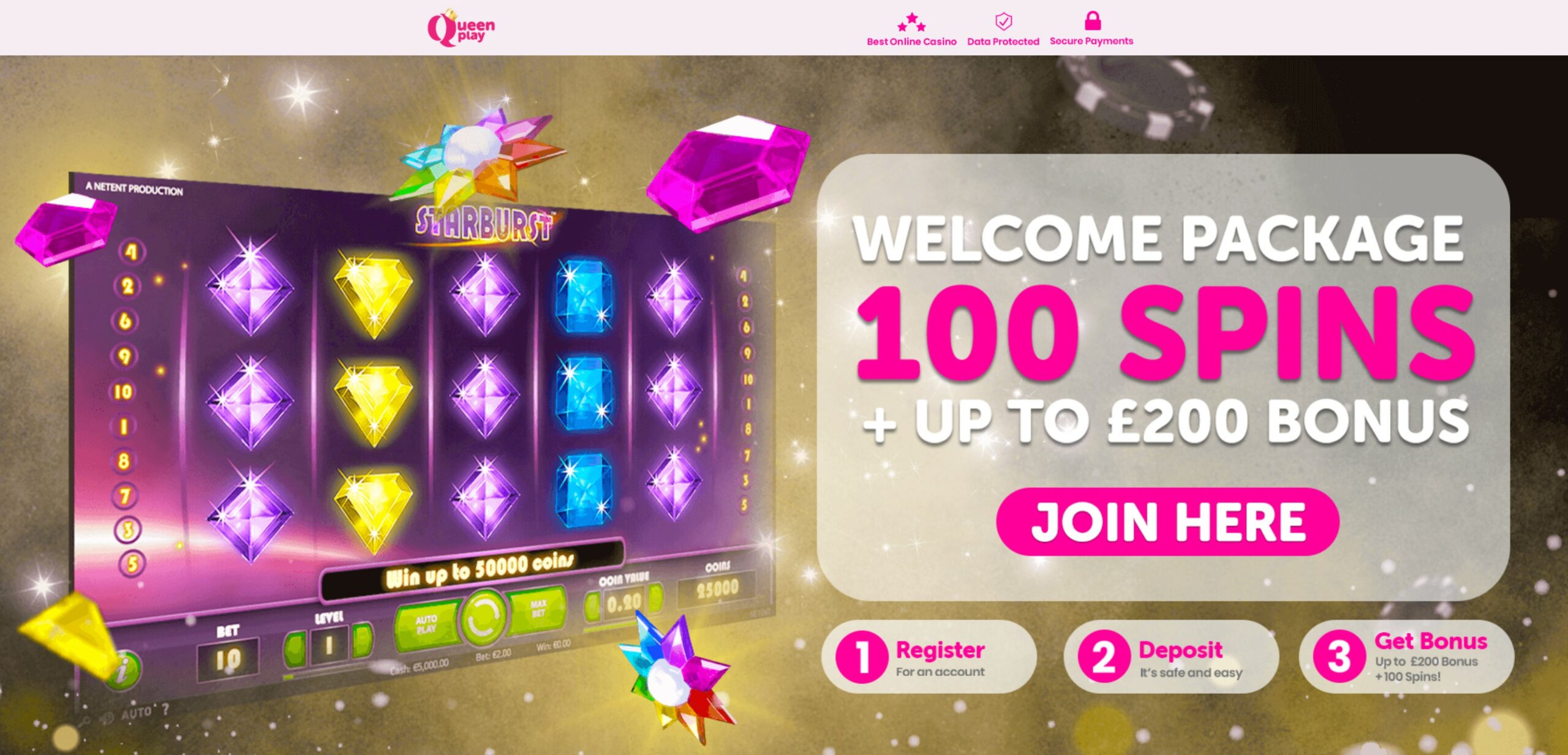

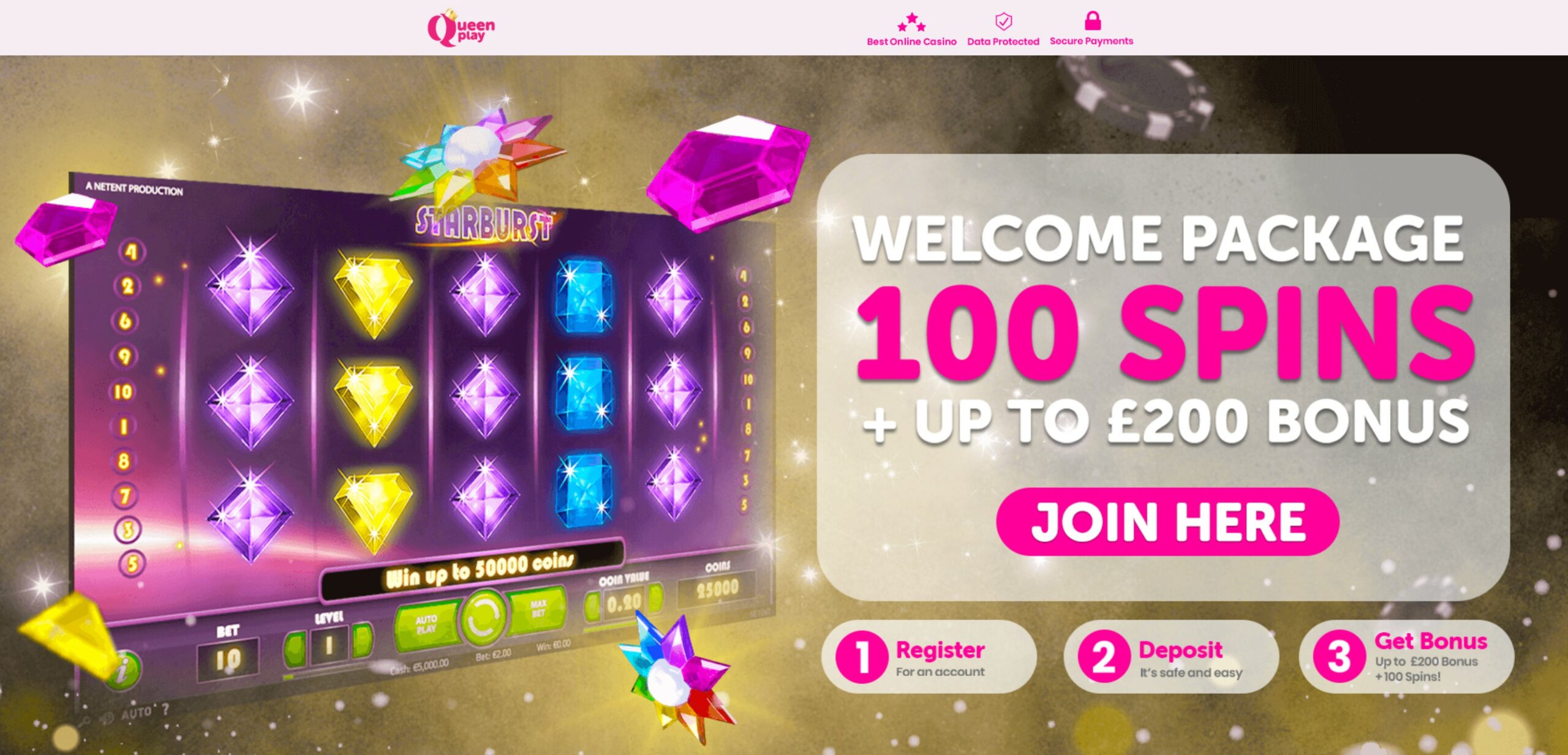

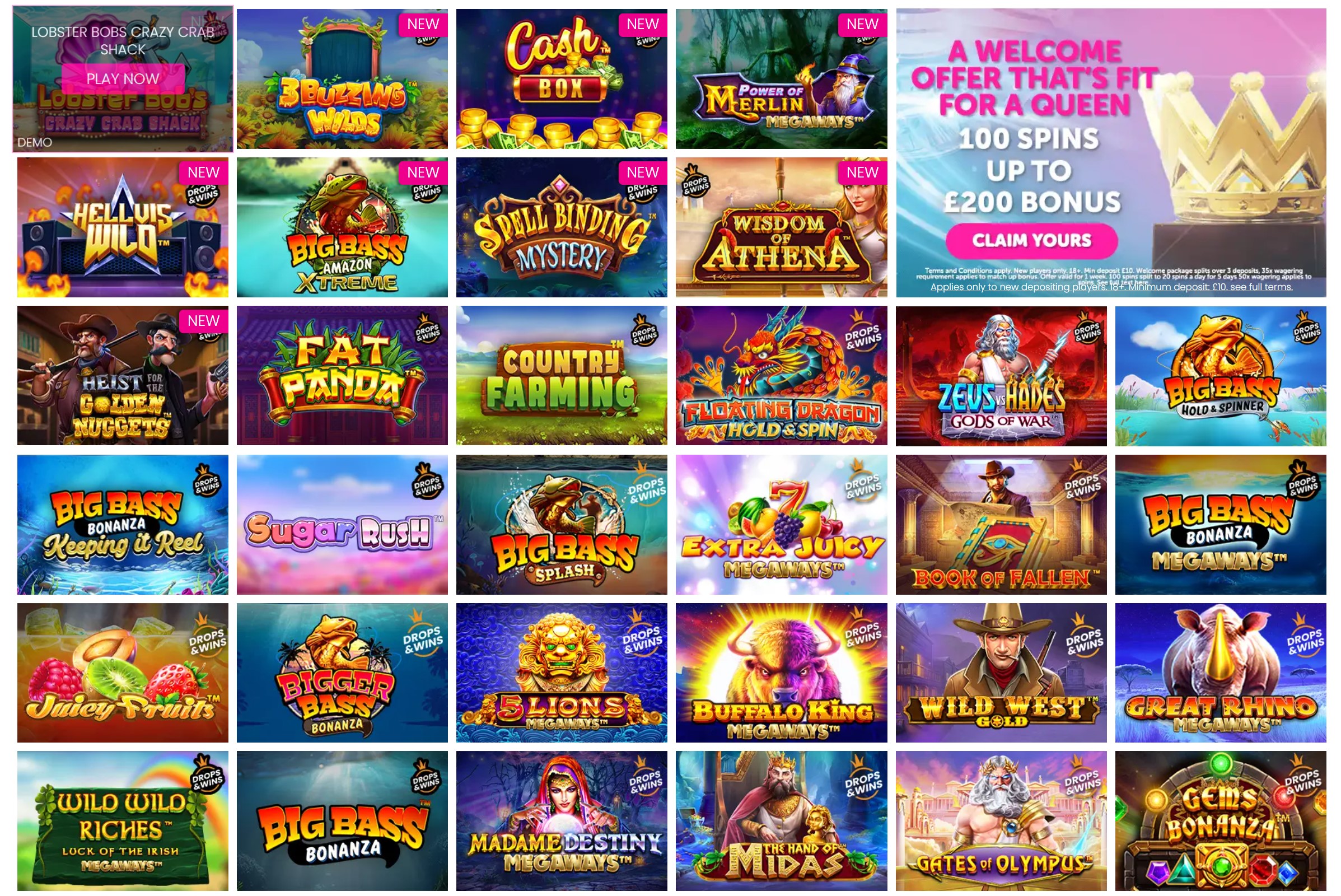

100 spins + up to £200 deposit bonusOnline Casino: Queenplay

Established: 2020

Company: Marketplay Limited

UK Gambling Licence link: 39483

Platform: Aspire Global

Banking options: Bank Wire Transfer, EcoPayz, MasterCard, Neteller, Paysafe Card, instaDebit, Visa, Entropay, EPS, Euteller, Bancontact/Mister Cash, Fast Bank Transfer, Trustly, Skrill, Wire Transfer, Skrill 1-Tap, Zimpler, Klarna Instant Bank Transfer, MuchBetter, Rapid Transfer, PayPal, Interac, AstroPay Card, CashtoCode, GiroPay

Mobile options: Over 1100 mobile games

Queenplay Casino Overview God save our noble queen! This queen is Maltese, though she rules over UK casino players too. Queenplay Casino is a brand from Aspire Global, via Marketplay, who run a slew of casino sites. This one is branded on games, games, games. There’s not much of a theme or gimmick to be ... READ FULL REVIEW

- 1X2gaming

- Ainsworth

- Aristocrat

- Bally

- Barcrest

- Betsoft

- Big Time Gaming

- Blueprint

- Booongo

- Cadillac Jack

- Elk Studios

- Evolution Gaming

- Ezugi

- GameArt

- Habanero

- High 5 Games

- IGT

- Inspired Gaming

- Irondog

- iSoftBet

- Lightning Box

- Magnet Gaming

- Microgaming

- NeoGames

- NetEnt

- NextGen

- Nolimit City

- NYX

- Old Skool Studios

- Oryx

- Pariplay

- Play 'N Go

- Playtech

- Pragmatic Play

- Quick Spin

- Quickfire

- Rabcat

- Realistic

- Red Rake

- Scientific

- SG Interactive

- Skillzzgaming

- SYNOT

- Thunderkick

- Tom Horn Gaming

- Triple Edge Studios

- WMS

- Trustworthy Company

- Large Number of Providers

- 100+ Live Casino Games

- No sportsbook or poker

Bonus Terms

First 3 deposits only. Min deposit £10. Max total bonus £500 and 150 spins. 30x wagering (dep + bonus). 30x on spins, 4x conversion, bonus and spins valid on selected slots Full T&C’s apply. #AD, 18+ only, Begambleaware.org

Up to £500 Bonus + 150 spinsOnline Casino: Fortune Mobile

Established: 2019

Company: Grace Media

UK Gambling Licence link: 57869

Platform: Markor

Banking options: Paypal, VISA, Debit Card, Trustly, Much Better

Mobile options: Over 900 mobile games

- Alchemy Gaming

- All41 Studios

- Aurum Signature

- Big Time Gaming

- Blueprint

- Buck Stakes

- Crazy Tooth Studio

- Evolution Gaming

- Eyecon

- Fortune Factory Studios

- Foxium

- Gacha Studios

- Gamevy

- Gold Coin Studios

- Golden Rock Studios

- Gong Gaming

- Habanero

- Hacksaw Gaming

- Half Pixel Studios

- Infinity Dragon

- JustForTheWin

- Leander

- Live 5 Gaming

- Markortech

- Matrix Studios

- Microgaming

- Neko Games

- Nektan

- Neon Valley Studios

- NetEnt

- Northern Lights

- NYX

- Pear Fiction Gaming

- Print Studios

- Pulse 8

- Rabcat

- Realistic

- Red Tiger

- Rising Entertainment

- Rocksalt Interactive

- Slingshot

- Snowborn

- Spin Play Games

- Stakelogic

- Stormcraft Studios

- Switch Studios

- Triple Edge Studios

- Yggdrasil

- Regular bonus spins

- Live chat + SMS support 24/7

- New slots weekly

- No live blackjack

- Limited live selection

Bonus Terms

This offer is only available for first time depositors. Min deposit is £10. 50 Free Spins on Book of Dead. Spin Value: £0.10. After your first deposit you may claim your 30 Extra Free Spins by visiting the Kicker Section. The Prize Twister awards a random prize of either cash or free spins. For Free Spins the general free spins terms apply. No min withdrawal. This offer cannot be used in conjunction with any other offer. This offer is only available for specific players that have been selected by PlayOJO. If you have arrived on this page not via the designated offer via PlayOJO you will not be eligible for the offer. OJO’s Rewards and Game Play policy applies.

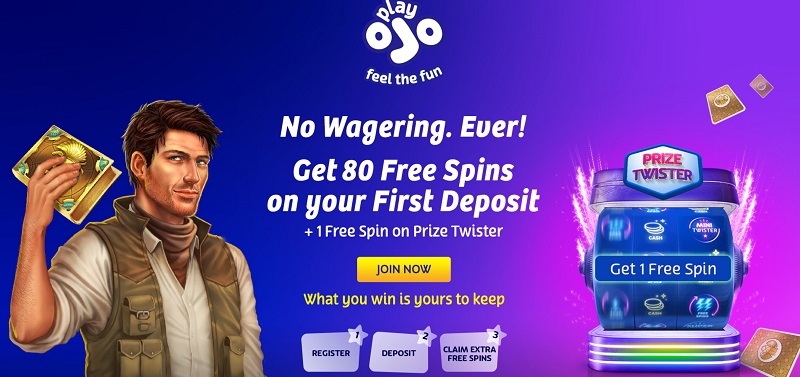

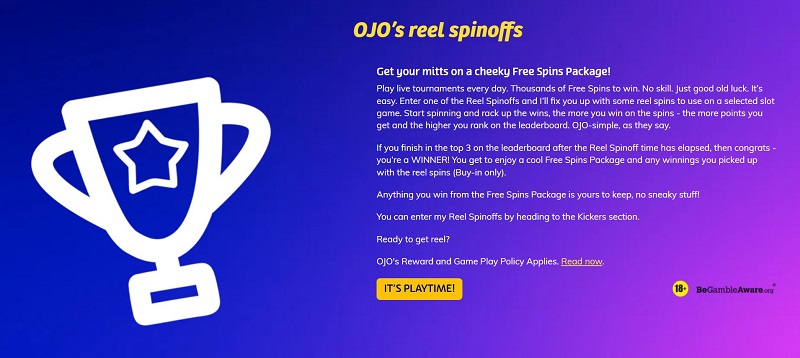

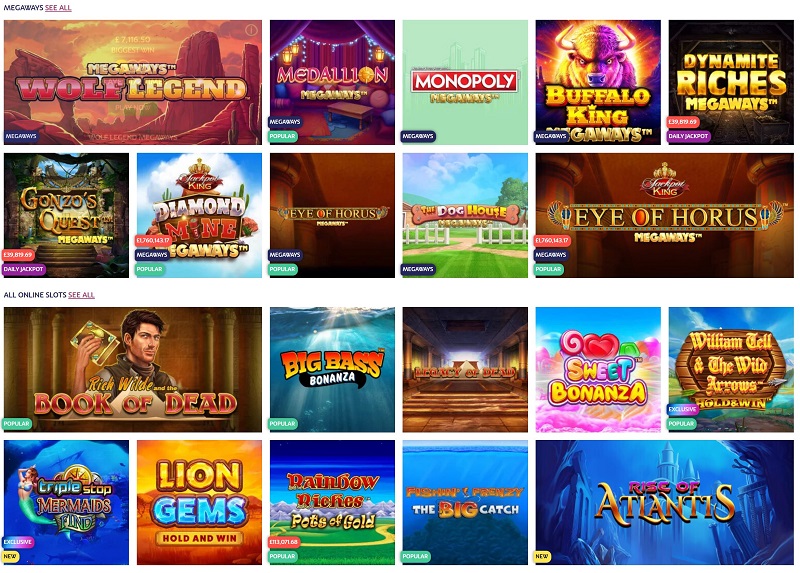

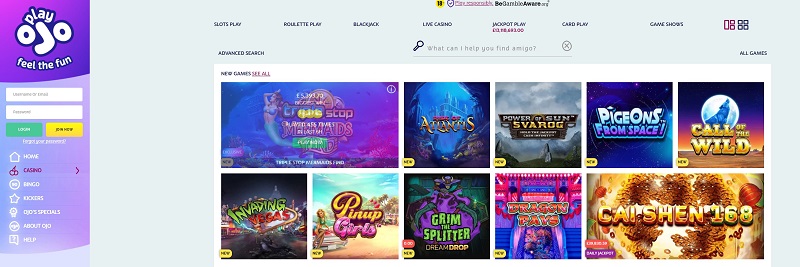

80 free spins on 1st deposit, no wageringOnline Casino: Play Ojo

Established: 2017

Company: SkillOnNet Ltd.

UK Gambling Licence link: 39326

Platform: Skill On Net

Banking options: 7Bank Wire Transfer, EcoPayz, Maestro, MasterCard, Neteller, PayPal, Paysafe Card, Visa, Sofort, Fast Bank Transfer, Trustly, Skrill, Instant Bank Transfer, Apple pay

Mobile options: Over 1000 mobile games

*Exclusive* online-casinos.co.uk offer: yes.

PlayOJO Casino Overview It seems not a day goes by without a new online casino joining the already crowded gaming scene. As competition increases, it gets more and more difficult to stand out and add value, and it’s so very refreshing to see a newcomer pull it off. Simple and transparent, PlayOJO Casino lives ... READ FULL REVIEW

- 1X2gaming

- 2by2 Gaming

- Amaya

- Authentic

- Bally

- Bally Wulff

- Barcrest

- Big Time Gaming

- Blueprint

- Booming Games

- Cayetano

- Edict

- Elk Studios

- Evolution Gaming

- Eyecon

- Foxium

- Gamomat

- Giveme

- Golden Hero

- Habanero

- High 5 Games

- Inspired

- Inspired Gaming

- Irondog

- iSoftBet

- JustForTheWin

- Kalamba

- Lightning Box

- Merkur

- MGA

- Microgaming

- NetEnt

- NextGen

- NYX

- Oryx

- Peter & Sons

- Play 'N Go

- Playtech

- Pragmatic Play

- Push Gaming

- Quick Spin

- Rabcat

- Realistic

- Red Tiger

- SG Interactive

- Slingo

- Spearhead Studios

- Stakelogic

- Switch Studios

- SYNOT

- Thunderkick

- Wazdan

- WGS Technology

- XPG

- Yggdrasil

- Established for 6+ years

- No wagering on free spins

- Tailored Promotions

- Tournaments

- No Betsoft Slots

- Neteller excluded from bonus

Fun Casino

- Use latest firewalls and 128-bit technology for security purposes

- Promotes responsible gambling

- 24/7 Live chat support

Bonus Terms

New players only. Maximum bonus is £123. Max bet with bonus is £5. No max cash out on deposit bonus offers. Wagering is 50x. Skrill & Neteller excluded. Eligibility is restricted for suspected abuse. Cashback is cash, so no wagering. Cashback applies to deposit where no bonus is included T&C Apply, 18+

100% up to £123 + EXCLUSIVE spins on Hot Fruits 27Online Casino: Fun

Established: 2018

Company: L&L Europe

UK Gambling License link: 38758

Banking options: Visa,MasterCard, Paysafecard,PayPal, Skrill, Neteller, iDebit, Interac, Trustly, Sofort, Giropay

& Bank transfer

Mobile options: Well optimized mobile website version.

With the recent expansion of online casinos, finding an adequate gambling website can be quite challenging. If you can’t seem to decide where to bet, why not check out Fun Casino? Fun Casino was launched in 2018, and since then, it has been an outstanding platform where you can play various casino classics and take ... READ FULL REVIEW

- Blueprint

- Elk Studios

- Evolution Gaming

- High Games

- IGT

- NetEnt

- NextGen

- Novomatic

- Thuderkick

- Huge Collection of Slot Titles

- Reliable Customer Support

- Mobile-Friendly Website

- Extensive FAQ Section

- A Variety of Accepted Payment Methods

- High Wagering Requirements

- Lack of Roulette Games

Bonus Terms

18+ T&C apply, qualifying games only, Wagering only when you are using your Bonus Balance, min deposit £10, offer valid for 24hrs, full T&C apply

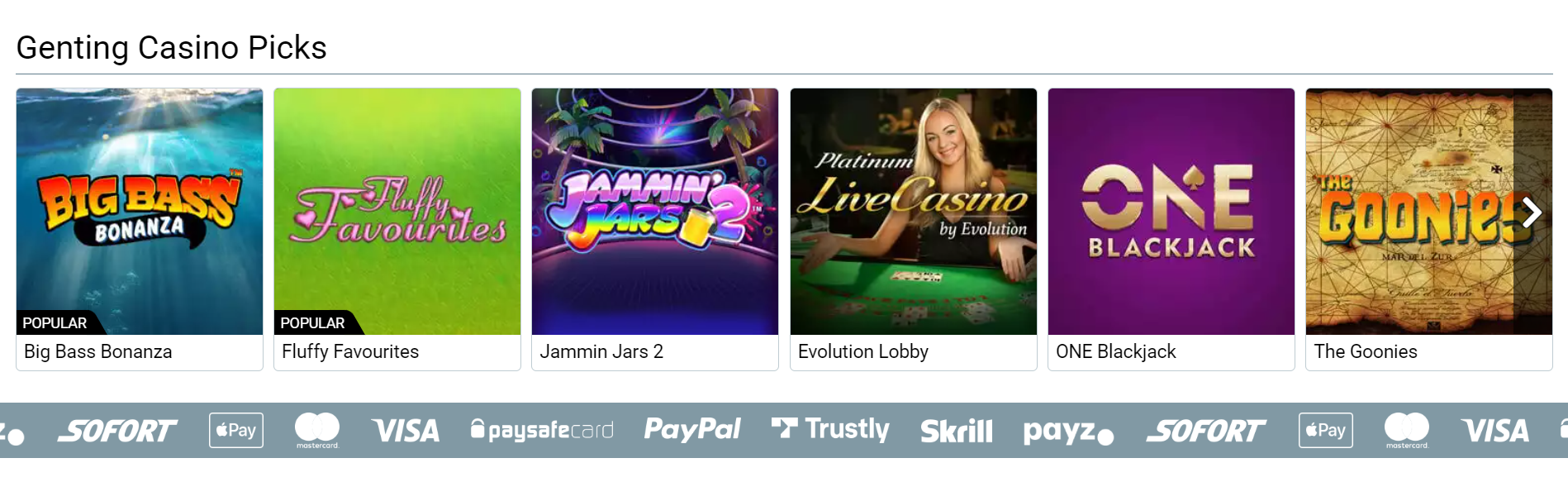

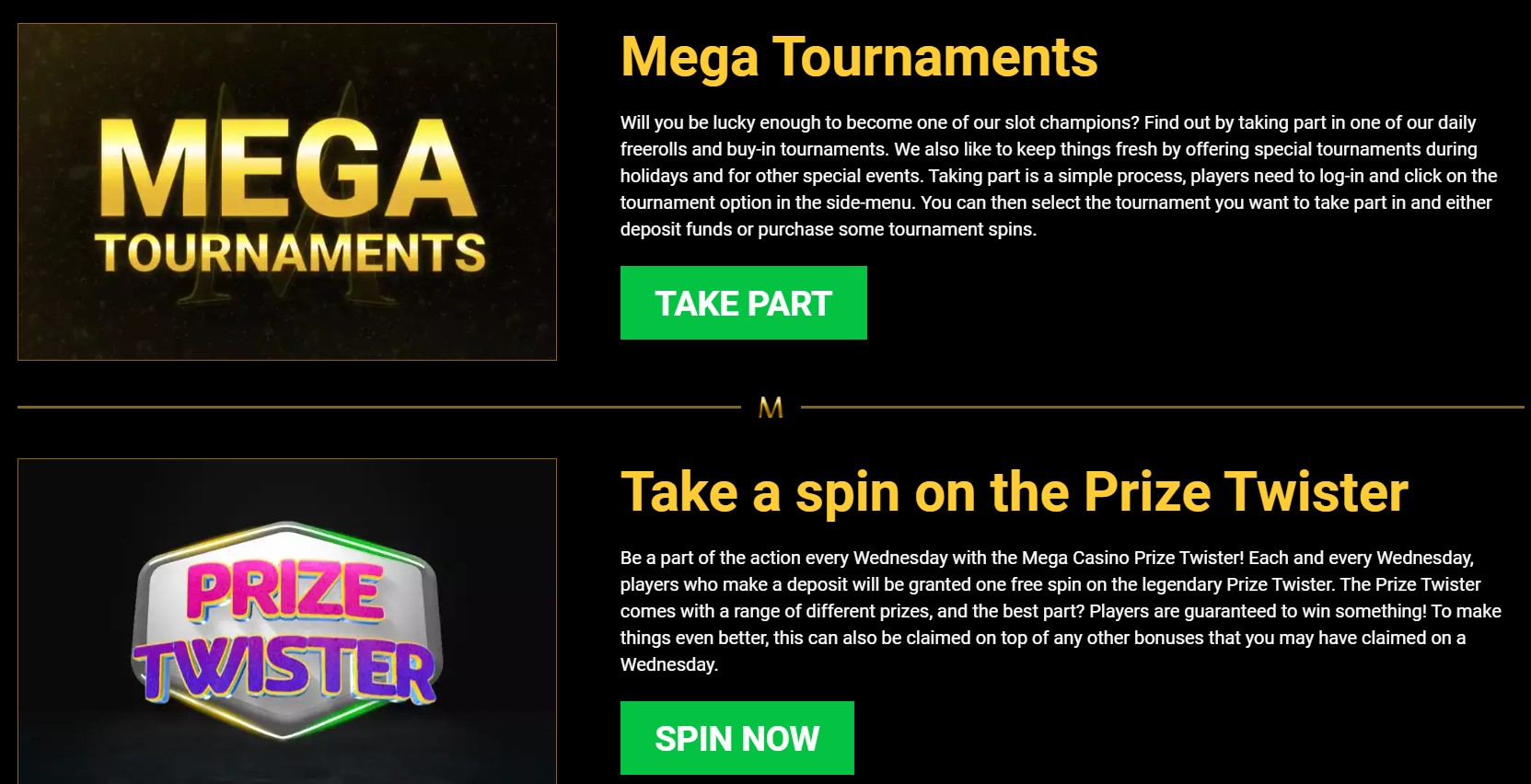

100% Bonus up to £50Online Casino: Genting Casino

Established: 1965

Company: Genting UK plc

UK Gambling Licence link: 537

Platform: SkillOnNet

Banking options: Visa, MasterCard, Paysafe Card, PayPal, Trustly, Skrill, Payz, Sofort, ApplePay

Mobile options: Over 6000 mobile games

If you are looking for an online casino in the UK that’s secure, has a hefty number of casino games in its library, and is player-oriented, our Genting Casino review is here to come to your rescue. This casino boasts many features that can bring so much fun and help you earn various prizes. ... READ FULL REVIEW

- Amaya

- Bally

- Barcrest

- Big Time Gaming

- Elk Studios

- Evolution Gaming

- Foxium

- GameArt

- Gamomat

- IGT

- Lightning Box

- Merkur

- Microgaming

- NetEnt

- NextGen

- NYX

- Play 'N Go

- Rabcat

- Realistic Games

- Red Tiger

- RT Gaming

- SkillOnNet

- Thunderkick

- WMS

- Yggdrasil

- Amazing Live Casino Section

- Trusted Payment Providers

- 50 Years of Casino Experience

- Safety Takes Center Stage

- Live Chat Availability

- Withdrawal Times Can Be Long

Bonus Terms

First Deposit Only. Min. deposit: £20, max. Bonus £250. Game: Book of Dead, Spin Value: £0.10. WR of 60x Bonus amount and Free Spin winnings amount (only Slots count) within 30 days. Max bet is 10% (min £0.10) of the free spin winnings and bonus amount or £5 (lowest amount applies). Free Spins must be used before deposited funds. First Deposit/Welcome Bonus can only be claimed once every 72 hours across all Casinos. Bonus Policy applies.

*exclusive* 100% bonus up to £250 + 111 spins with bonus code OC111Online Casino: Mega Casino

Established: 2010

Company: Prime Gaming

UK Gambling Licence link: 39326

Platform: SkillOnNet

Banking options: Visa, MasterCard, Neteller, Paysafe Card, Trustly, Paypal, Payz, Sofort, Apple Pay

Mobile options: Over 5000 mobile games

*Exclusive* online-casinos.co.uk offer: yes.

Mega Casino Review Mega Casino UK are quite well established now, having been founded in 2012. They’ve got all the licensing you might want to see and come from a very well-known and big European casino company. They also have a great bit of marketing because they’ve made a millionaire. It’s going back a bit ... READ FULL REVIEW

- 1X2gaming

- 2by2 Gaming

- 4 The Player

- All41 Studios

- Bally

- Barcrest

- Bgaming

- Big Time Gaming

- Blueprint

- Booming Games

- Cayetano

- Elk Studios

- Evolution Gaming

- Eyecon

- Ezugi

- Fantasma Games

- Foxium

- G Games

- Gaming Corps

- Gamomat

- Giveme

- Golden Hero

- Grand Vision

- Green Jade

- Hacksaw Gaming

- High 5 Games

- Inspired

- Irondog

- iSoftBet

- JustForTheWin

- Kalamba

- Leander

- Lightning Box

- Max Win

- Merkur

- Microgaming

- NetEnt

- NextGen

- Nolimit City

- NYX

- Oryx

- Peter & Sons

- Play 'N Go

- Playson

- Playtech

- Pragmatic Play

- Push Gaming

- Quick Spin

- Rabcat

- Realistic

- Red Rake

- Red Tiger

- Reel Play

- Relax Gaming

- RT Gaming

- Slingo

- Spade Gaming

- Spearhead Studios

- Stakelogic

- STHLM Gaming

- Stormcraft

- Switch Studios

- SYNOT

- Thunderkick

- Wazdan

- Winshot

- WMS

- Yggdrasil

- 5000+ Games

- Large Casino Group

- 10+ Years Old

- Own Branded Slots

- Questionable Randomness Reported

Online-Casinos.co.uk – Your UK Online Casino Guide Since 1999

Online-Casinos.co.uk is the most established online casino guide in the UK, helping players to carefully choose the best UK online casinos since 1999.

As well as using meta-review metrics to determine the best UK online casinos, our experienced team of gambling experts understands exactly what makes online casinos great and how to choose a UK casino site that is right for you.

We know that big casino bonuses and flashy graphics are only part of what makes a great UK casino site—you can be sure that the online casinos we recommend have something extra special.

At Online-Casinos.co.uk, we offer more than just a casino comparison site. Our in-depth articles and guides to every aspect of online gambling will arm you with the expertise you need to make your online casino experience more fun.

Meet the Online-Casinos.co.uk Team Members

The Online-Casinos.co.uk team is made up of gambling experts passionate about providing UK players with an informed, enjoyable, and rewarding gambling experience. We specialize in performing in-depth research and evaluation and producing comprehensive reviews, all with players in mind. Our commitment is only to recommend licensed and reputable casinos that meet our strict criteria.

UK Online Casinos Reviews by Experts—Our Methodology

At Online-Casinos.co.uk, we’re well aware that you seek to play at the top UK online casinos. That is why we provide in-depth online casino reviews to help you pick one that suits your needs best!

All our reviews are 100% fair and unbiased; what’s more, they are written by a team of gambling experts who dedicate their time and effort to testing every single feature for your ultimate convenience.

Our goal is to help you make an informed decision. To achieve this goal, our online casino reviews focus on the ins and outs of the top UK casino sites.

To come up with a comprehensive online casino review, we conduct thorough research every month. We consider the following factors when ranking the top 20 online casinos in the UK:

- Safety and security. Safe gambling is a high priority, so we recommend only those casinos that are legal, licensed, and comply with contemporary standards.

- Online casino reputation. We want you to play only at trusted online casinos, so we pay close attention to their reputation among the gambling community.

- Game selection and software providers. You deserve to play the best games, so we explore game collections and their quality, RTP percentage, and software providers.

- Promotions, bonuses, and tournaments. Various promotions and bonuses may sound flashy and attractive, but they always come with fine print. We’re here to analyze it for you to make sure you only get the best of the best.

- Payment options. To earn a spot on our list of the top 20 UK casinos, an online casino has to accept various payment methods.

- Customer support. Any issues customers face should be dealt with immediately. Therefore, we evaluate not only the availability of online casinos’ customer support but also the speed of their response.

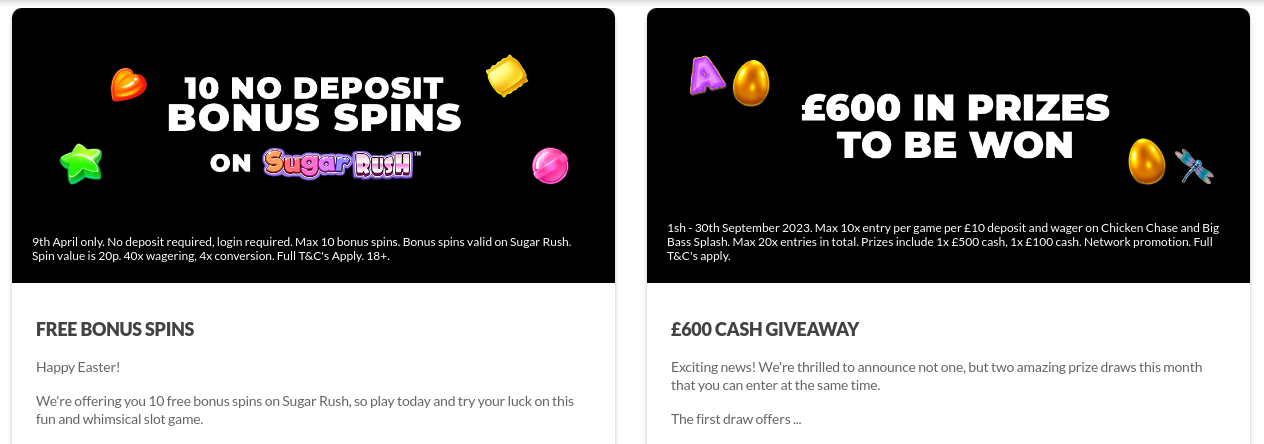

Latest UK Online Casino Promotions and Bonuses

Our team is constantly on the lookout for the latest casino competitions, bonuses and promotions from all the leading UK online casinos, and we feature the very latest bonuses on our dedicated Latest UK Casino Bonuses page. So head on over if you want to check out the full list of up-to-the-minute news on all the latest casino bonuses, updated daily!

- Play More with the Daily Spin Frenzy of MagicRed CasinoApril 26th, 2024: If you’re a slots fan, check out MagicRed Casino’s Daily Spin Frenzy, a daily promotion that rewards UK players up to 50 free spins. The number of bonus spins depends on your total wager for the day, with a bet worth £100 earning 10 spins and wagering more than £1,000 gets 50 bonus spins. So, the more games you play, the more spins you collect daily. The bonus comes with a 35x wagering requirement, and qualifying games may vary weekly. So, don’t forget to check your in-game and email notifications daily to check your progress. Complete four … Read more

New UK Casino Slots Games

We love brand new slots games and are constantly monitoring UK online casinos and games providers so that we can let you know as soon as a new slot game becomes available. Our new slot reviews page is updated every day with the latest news about new slot releases. Our mini reviews contain everything you need to know about new slots including which slot provider they are from, the style of slot, payouts, RTP, bonus rounds etc. Be sure to check it out if you want to keep your finger on the pulse of the latest developments in online slots!

- Legend of Lilith Slot by SpinomenalApril 9th, 2024: Spinomenal’s Legend of Lilith is a 5-reel, 4-row slot machine with a fiery theme focusing on a legendary warrior. This thrilling slot is the latest addition to Spinomenal’s mythology series of slots, which boasts a fiery background, colorful paying symbols, and a mysterious female warrior. The Legend of Lilith is played on 10 to 100 paylines and has an RTP of 96.04%. The slot boasts special features such as Free Spins, Stacked Wild, and Buy Feature and a top payout of up to 3,000x the stake! Discover the power and mystery of the … Read more

Top 10 Slots to Play in UK Online Casinos

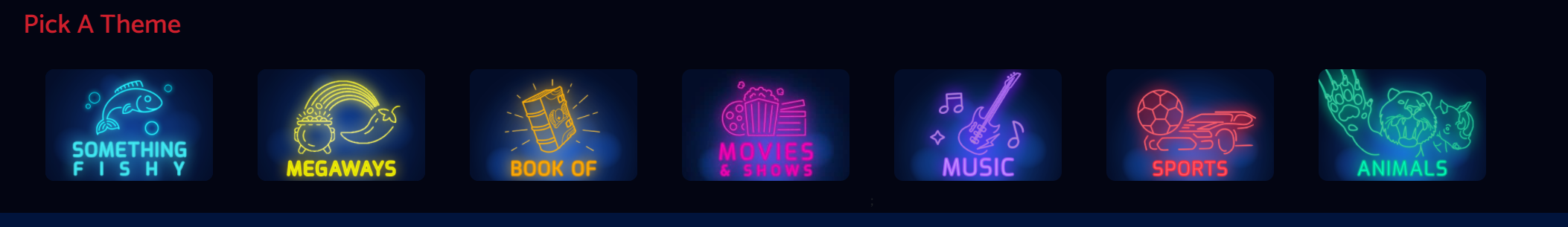

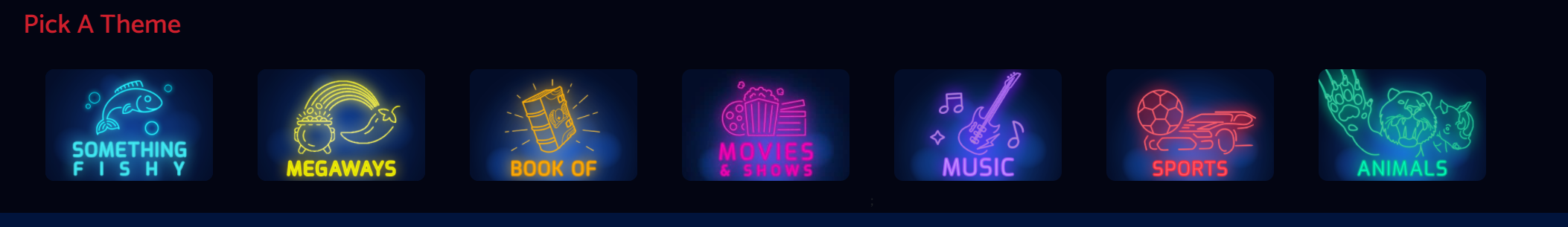

Slots have always been one of the most popular and played games in online casinos in the UK. The reason for that is fairly obvious: you have a high potential to win lucrative rewards and jackpots in a single spin. Given their popularity, it’s no wonder that new slots are launched weekly.

Slots are also popular among gamblers due to the variety of themes they follow. Thus, you can travel to Ancient Egypt and take a few spins, or you can embark on a mission to explore outer space.

Film enthusiasts, fairytale lovers, comic aficionados, and animal lovers—there is something nice for you too.

No matter if you’re looking for classic, progressive, or video slots, we’ve prepared an extensive list of the top 10 slots in online UK casinos.

- #1. Dragon Slots

- #2. Vampire Slots

- #3. Adventure Slots

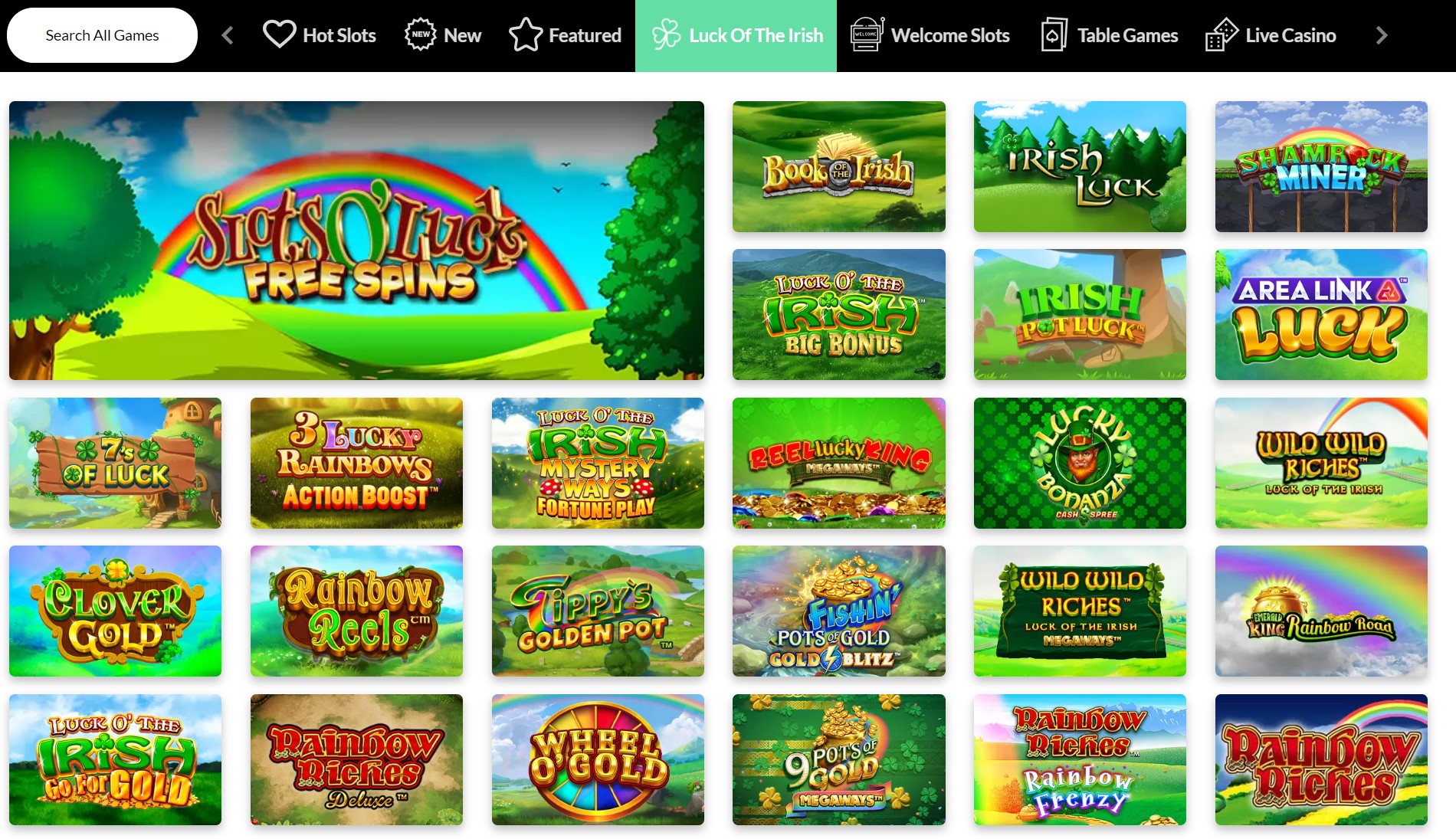

- #4. Irish Slots

- #5. Anime Slots

- #6. TV Slots

- #7. Bandit Slots

- #8. Diamond Slots

- #9. LuckyMe Slot

- #10. Aztec Slots

Top 10 UK Online Casino Sites in April 2024 List

- Betfred – best overall online casino in the UK and best UK blackjack casino (£10m blackjack game)

- VegasLand Casino – best live dealer games (100+ live games)

- Yeti Casino – best mobile casino (1,900+ games)

- All British Casino – best roulette casino (Live roulette games powered by NetEnt)

- Pub Casino – top new UK casino (Launched in 2023)

- Playzee Casino – best loyalty program (Daily promotions)

- PlayOJO Casino – fastest payouts (Instant)

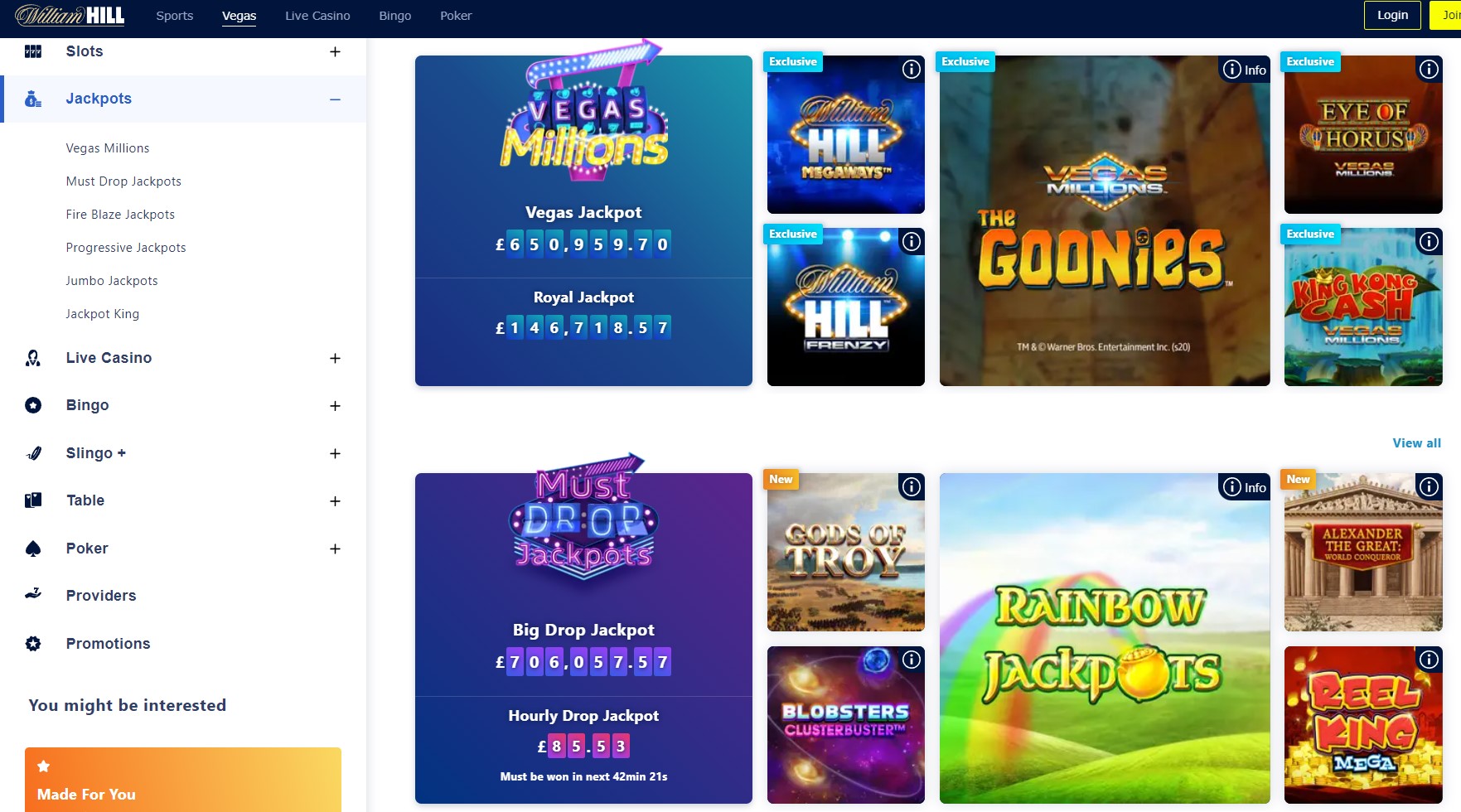

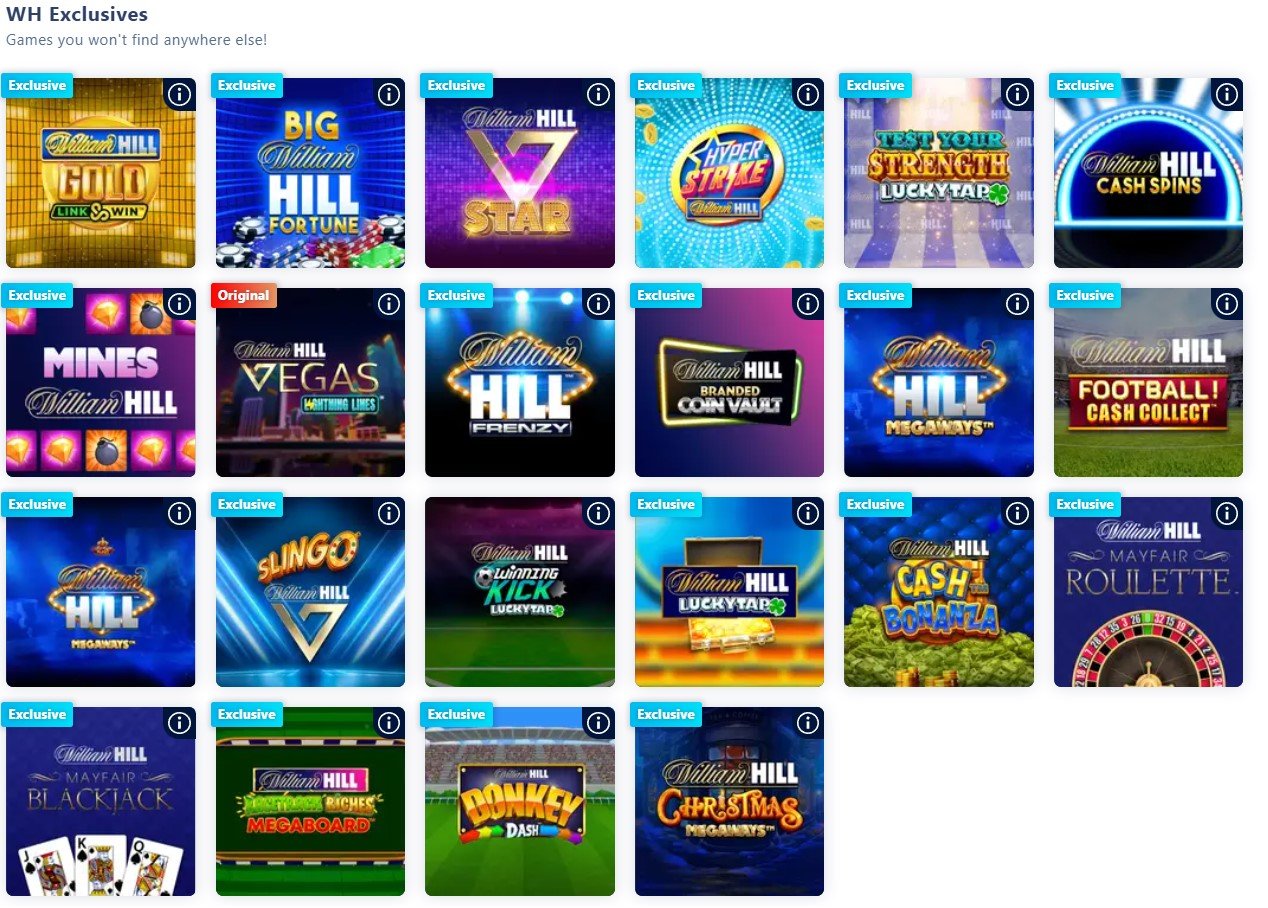

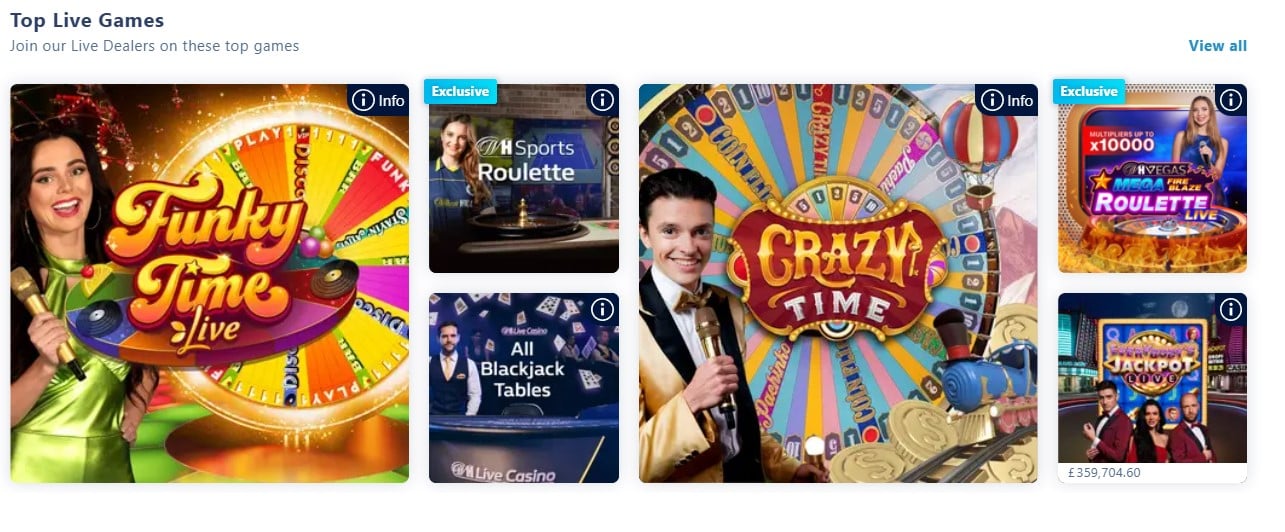

- William Hill Casino – best blackjack casino (24 games + best possible RTP)

- Jackpotjoy Casino – best customer support (Available 24/7)

- Captain Spins Casino – best sign-up bonus (Up to 520 spins, T&Cs apply)

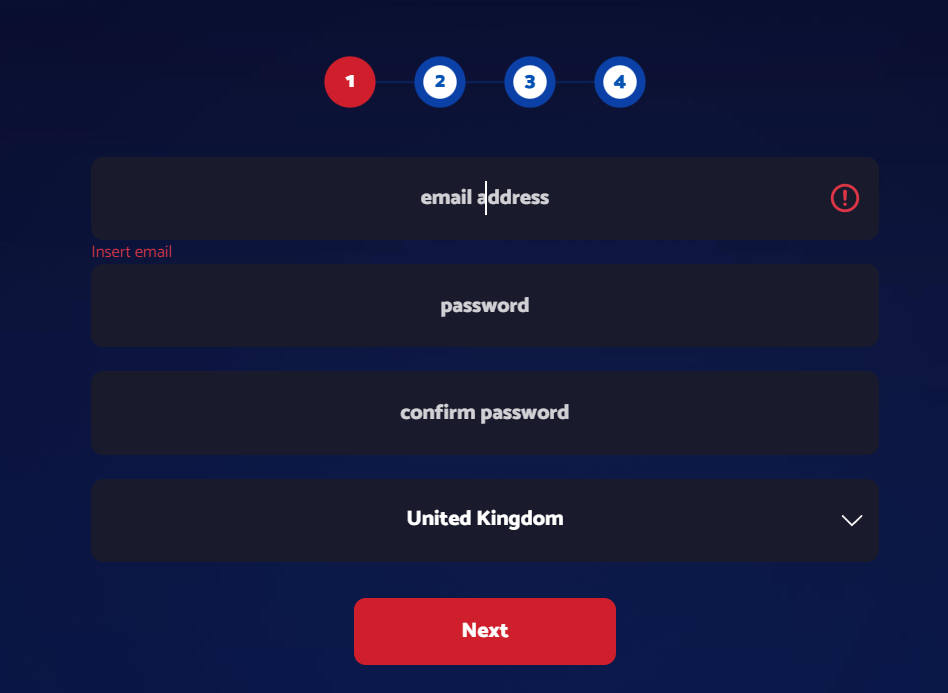

How to Make Deposits and Withdrawals at Online Casinos UK

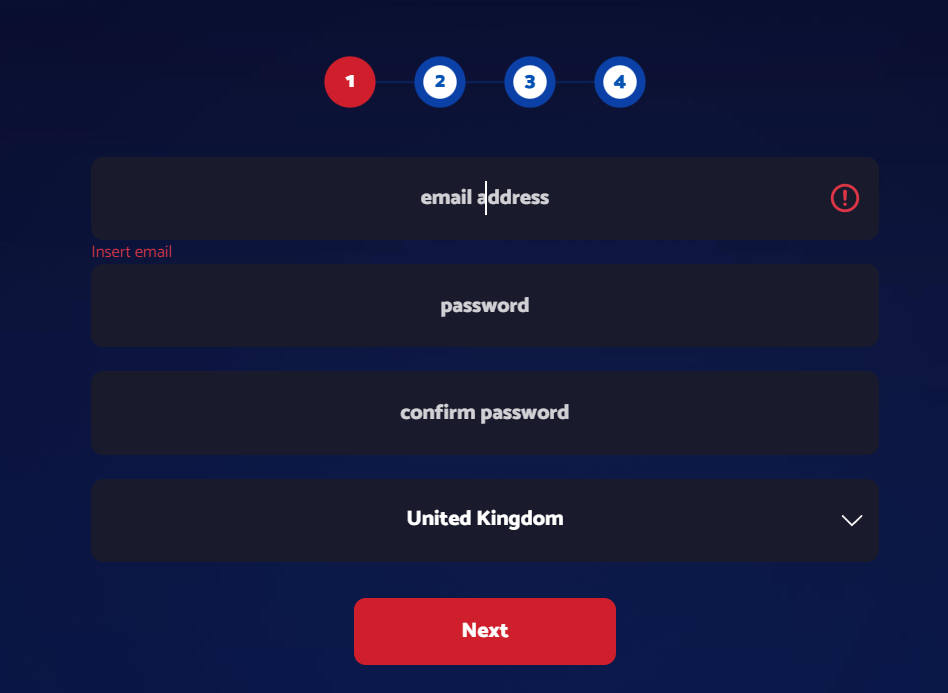

Having picked the best online casino in the UK and registered an account there, there is one step left to do before gambling: making a deposit.

To do so, follow the next steps:

- Visit the casino’s Cashier page, then select Deposit

- Pick your preferred payment option. You can choose from PayPal, e-wallets, credit/debit cards (Visa or Mastercard), prepaid cards, and cryptocurrencies, or you can pay by phone.

- Follow the instructions and provide the necessary information

- Enter the amount you want to deposit

- Check the transaction for mistakes

- Confirm to finish the process

Though most of the best online casinos in the UK support instant deposits, the transfers may take time, depending on the payment method you opt for.

A word of warning: always use well-known and reliable payment methods to avoid putting both your money and credentials at risk.

Withdrawing money is the same as depositing it. To cash out your winnings, here is what you need to do:

- Go to the Cashier page and choose Withdrawal

- Select the preferred payment option

- Follow the instructions and fill in the required fields

- Add the desired withdrawal amount

- Review the transaction and confirm it

The funds should be in your account in no time. In case you stumble upon any issues while making deposits or withdrawals, don’t hesitate to reach out to the customer support of that casino.

Payment Methods Accepted at Online Casinos in the UK

Both casual and seasoned gamblers are well aware that choosing an adequate payment method is among the key aspects of playing at online casinos, as that can affect the entire gambling experience. In the UK, you can choose from a pool of payment options, each of which has its pros and cons.

The payment methods accepted across online casinos in the UK are shown in the table below.

Bank transfer | £10 | £10,000 | £100,000 | 3-7 days | Widely accepted |

Debit and credit cards (Mastercard, Visa, or American Express) | £1 | £10,000 | £50,000 | 1-5 days | Best for high-rollers |

£10 | £5,000 | £1,000 | Instant | Easy to use | |

£10 | £5,000 | £1,000 | Instant | Fast payouts | |

£1 | £1,000 | £1,000 | Instant | Quick and easy to use | |

Cryptocurrency/Bitcoin | £1 | £100,000 | £10,000 | Instant | Blockchain-secured |

Prepaid card (Neosurf, Paysafecard) | £5/£10 | £750 | N/A | N/A | Anonymous deposits |

£5/£10 | £30 per day | £250 | N/A | Easy to use |

How to Choose the Best Online UK Casino for You

Considering the pool of online casinos on the UK market, one can’t help but wonder how to choose the best one. Plus, given the fact that not all casinos are created equal, having a clear definition of what to look for in one could be quite useful. After all, for a rewarding gambling experience, it’s critical that you opt for a casino that suits both your needs and your gambling style.

So, what elements do you need to take into consideration when choosing an online casino? Let’s find out!

#1. Regulation and Licenses

The first thing to consider in your quest for the best casino is whether it’s licensed and regulated. These affirm that the online casino has met all the necessary standards, requirements, and guidelines. Most importantly, you can rest assured that it provides fair gameplay, where the outcomes are determined at random.

Besides, licensed casinos have KYC (know-your-customer) policies and regulations whereby a player needs to confirm their identity. These policies oblige casinos to keep the players’ credentials protected and secure.

The absence of licenses and regulations at a casino should never be ignored, as they may be the primary indication of a rogue casino.

#2. Security and Support

Online gambling involves depositing and withdrawing real money; therefore, it’s critical to ensure that the casino you’re using is reliable and secure. Pick the one that guarantees the privacy and safety of your credentials.

To make sure that your personal information is protected, opt for a casino that has an SSL certificate. Plus, the casino should also verify your identity upon signing up to ensure that you’re legally entitled to gamble.

Don’t forget about customer support. Though you might never have come across any issues, no one can tell if things will always run smoothly. A good casino will allow gamblers to contact support in various ways—via email, chat, phone calls, etc.

#3. The Choice of Games

Another factor to take into consideration is the variety of games offered by a casino. In most cases, players have their preferred games or software developers that they stick to. Thus, before registering at a casino, go through their list of games and software providers to make sure your favorites are included.

The majority of casinos let prospective players browse their game selection, so take advantage of this, as it will help you make up your mind and choose the right online casino for you.

#4. Supported Payment Options

Being limited to one or two payment methods is never desirable. Hence, supported payment options could also be a reflection of an online casino’s quality. After all, the one that supports your preferred option of depositing and withdrawing funds is definitely a good choice.

Also, keep in mind the minimum and maximum amounts you can deposit or withdraw before registering. No matter how good a casino is, if the amounts don’t meet your needs or requirements, it’s not the best choice for you.

#5. Welcome Offers and Bonuses

Everyone loves bonuses! For this reason, before you register, check out the new player bonus policy. Select the one that gives a generous welcome bonus to new gamblers, offers free spins, or has a solid loyalty program.

However, make sure that you always read the terms and conditions of a casino; what’s more, pay attention if there is any fine print. Not all casinos have the same bonus policies, so you would certainly want to know what’s in store for you before signing up.

#6. Site Features and Smartphone Optimization

When looking for a brick-and-mortar casino, you will choose the one whose interior appeals to you. The same applies to online casinos. If the casino design doesn’t attract you as soon as you visit it, chances are that the gambling experience won’t be as enjoyable.

Note that the looks of the casino are not the only factor that matters, though. For the maximum experience, the online casino should be intuitive and easy to navigate with as few clicks as possible.

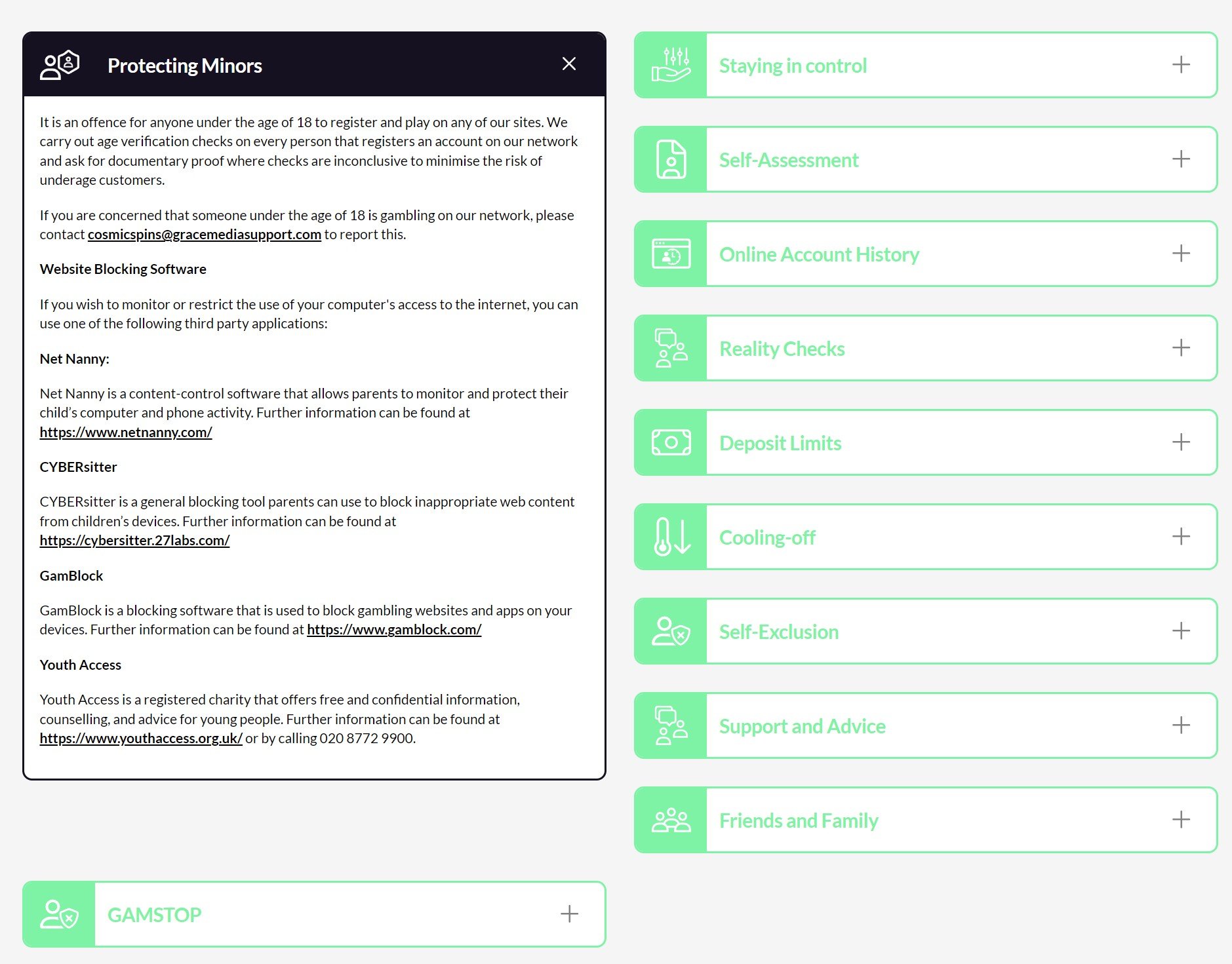

Play it Safe: The Importance of Responsible Gambling at Online UK Casinos

Online gambling is all fun and games until it turns into an addiction. At Online-Casinos.co.uk, we firmly believe that gambling safety is just as important as having fun.

As addiction is no fun, online casinos should make responsible gambling a priority. Thus, online casinos should offer resources you can turn to if necessary.

These resources provide information, support, and guidance to individuals who seek to gain or keep control over their gambling activities. As such, they are invaluable in promoting a safe and enjoyable experience.

Some of the resources online casinos should offer include, but are not limited to, the following:

Tips on How to Gamble Responsibly

When gambling, either online or in person, it’s easy to get carried away by excitement and emotions. Therefore, keeping your head cool and approaching the games responsibly is critical. The following pieces of advice will help you ensure your gambling remains an enjoyable pastime.

- Limit your bets. Before you start playing, decide what amount of money you can allocate to gambling and stick to it. You can do so by depositing small sums or using prepaid cards. This way, you will be able to avoid both gambling and financial issues.

- Set time limits. It’s hard to track time when you’re having fun, even more so when you’re losing a game. Therefore, set a time limit for gambling and involve yourself in other activities as well.

- Take breaks. If you keep gambling for extended periods of time, chances are that you will lose not only your focus but also your time and money. Step away from your computer or phone at regular intervals to clear your head, take a breath of fresh air, or have a bite to eat.

- Walk away from losses. If you’ve spent all the money that you previously allocated to gambling, it’s time to call it a day. Don’t try to win back the money you’ve lost, as it can incur even greater losses.

- Avoid gambling under the influence. Though gambling is associated with high spirits, avoid being under the influence while you’re playing. It will affect your judgment, so your decision-making may not be as sharp as usual, eventually leading to losing your money.

Top Online UK Casinos for Playing Your Favorite Games

Myriads of quality online casinos on the market make it challenging to stick to only a few games. Besides, new games that are added to casinos almost every week make this challenge even tougher.

We at Online-Casinos.co.uk have set out on a mission to make a list of the best casinos specially for you. The following list features the best UK online casinos where you can find a plethora of different games.

Best Online Casinos for Mobile Gambling

1

Yeti

- 256-bit encryption technology for data protection

- Uses KYC procedure

- Customer support via Live Chat

Bonus Terms

18+, min deposit £10, wagering 60x for refund bonus, max bet £5 with bonus funds. Free Spins bonus has x40 wagering. 23 free spins on registration (max withdrawal is £100). 100% refund bonus up to £111 + 77 spins on 1st deposit. No max cash out on deposit offers. Eligibility is restricted for suspected abuse. Welcome bonus excluded for players depositing with Ecopayz, Skrill or Neteller. Full T&Cs apply 18+, BeGambleAware, #Ad

100% refund bonus up to £111 + 100 extra spins

Online Casino: Yeti

Established: 2017

Company: L&L

UK Gambling Licence link: 38758

Platform: L&L

Banking options: Instant EFT - ZA, Skrill, Neteller, EcoPayz, MuchBetter(IN), Jeton - (IN), Visa, Mastercard, Paysafecard, Trustly, Euteller, Zimpler, PayPal UK, Poli, Instant Transfer through Netbanking (IN), UPI (IN) Bank transfer ApplePay (UK/SE/NZ).

Number of games: Over 1900

If you’re looking for a place to play some casino classics such as slots, blackjack, roulette, or others, you’ve come to the right place! Have you heard of Yeti Casino?

Yeti Casino has everything a typical gambler could want—generous bonuses, high-quality games, tournaments, reliable customer support, and more. But what makes this place special in comparison to other online casinos in the industry?

This Yeti Casino review will provide you with all the answers and help you decide whether you should check it out or not.

So, let’s see what it’s all about!READ FULL REVIEW

- 1X2gaming

- Amatic

- Bally

- Barcrest

- Blueprint

- Elk Studios

- Evolution Gaming

- Eyecon

- High 5 Games

- Irondog

- JustForTheWin

- Lightning Box

- Merkur

- Microgaming

- NetEnt

- NextGen

- Nolimit City

- Novomatic

- NYX

- Play 'N Go

- Pragmatic Play

- Scientific

- Slingo

- Thunderkick

- WMS

- Fast Payout Times

- Numerous Bonuses and Promotions

- Outstanding Customer Support

- Monthly Tournaments

- A Wide Range of Slingo Games

- High Wagering Requirements

Go to Yeti!

Go to Yeti!

Yeti

- 256-bit encryption technology for data protection

- Uses KYC procedure

- Customer support via Live Chat

Bonus Terms

18+, min deposit £10, wagering 60x for refund bonus, max bet £5 with bonus funds. Free Spins bonus has x40 wagering. 23 free spins on registration (max withdrawal is £100). 100% refund bonus up to £111 + 77 spins on 1st deposit. No max cash out on deposit offers. Eligibility is restricted for suspected abuse. Welcome bonus excluded for players depositing with Ecopayz, Skrill or Neteller. Full T&Cs apply 18+, BeGambleAware, #Ad

100% refund bonus up to £111 + 100 extra spinsOnline Casino: Yeti

Established: 2017

Company: L&L

UK Gambling Licence link: 38758

Platform: L&L

Banking options: Instant EFT - ZA, Skrill, Neteller, EcoPayz, MuchBetter(IN), Jeton - (IN), Visa, Mastercard, Paysafecard, Trustly, Euteller, Zimpler, PayPal UK, Poli, Instant Transfer through Netbanking (IN), UPI (IN) Bank transfer ApplePay (UK/SE/NZ).

Number of games: Over 1900

If you’re looking for a place to play some casino classics such as slots, blackjack, roulette, or others, you’ve come to the right place! Have you heard of Yeti Casino?

Yeti Casino has everything a typical gambler could want—generous bonuses, high-quality games, tournaments, reliable customer support, and more. But what makes this place special in comparison to other online casinos in the industry?

This Yeti Casino review will provide you with all the answers and help you decide whether you should check it out or not.

So, let’s see what it’s all about!READ FULL REVIEW

- 1X2gaming

- Amatic

- Bally

- Barcrest

- Blueprint

- Elk Studios

- Evolution Gaming

- Eyecon

- High 5 Games

- Irondog

- JustForTheWin

- Lightning Box

- Merkur

- Microgaming

- NetEnt

- NextGen

- Nolimit City

- Novomatic

- NYX

- Play 'N Go

- Pragmatic Play

- Scientific

- Slingo

- Thunderkick

- WMS

- Fast Payout Times

- Numerous Bonuses and Promotions

- Outstanding Customer Support

- Monthly Tournaments

- A Wide Range of Slingo Games

- High Wagering Requirements

Are you a fan of online gambling on your smartphone? If the answer is yes, then Yeti Casino is the perfect pick for you.

Founded in 2017, Yeti Casino offers everything a gambler could wish for—attractive bonuses, high-quality games, reliable customer support, great tournaments, etc.

Yeti Casino boasts fast payout times—all deposits and withdrawals are processed within 24 hours. This online casino also knows how much everyone loves bonuses and promotions, and it doesn’t shy away from giving generous ones.

However, if you’re a crypto enthusiast, Yeti Casino might not be the right pick for you, as it doesn’t support cryptocurrency payments as of the moment of writing. Though it offers huge bonuses, keep in mind that Yeti Casino has high wagering requirements (40x).

Best Online Casinos for Slots

1

Pub Casino

- Fast payment options.

- SSL Data Encryption Security

- Various responsible gambling options available

Bonus Terms

Welcome bonus for new players only | Maximum bonus is 100% up to £100 | Min. deposit is £10 | No max cash out | Wagering is 45x bonus | Maximum bet with an active bonus is £5 Eligibility is restricted for suspected abuse | Skrill & Neteller deposits excluded for welcome bonus | Cashback when offered, applies to deposits where no bonus is included | Cashback is cash with no restrictions |

100% up to £100

If you’re looking for an online gambling establishment that provides not just the standard fare of table games and live dealer options but also some of the top slot machines in the industry, you should check out Pub Casino! Pub Casino offers a wide selection of games, great signup bonuses, prompt payments, helpful customer service, ... READ FULL REVIEW

- Big Time Gaming

- Blueprint

- Elk Studios

- Evolution Gaming

- Eyecon

- Hacksaw Gaming

- Inspired

- Microgaming

- NetEnt

- Nolimit City

- Novomatic

- Play 'N Go

- Pragmatic Play

- Red Tiger

- Slingo

- Thuderkick

- Huge Slot Library

- Fast Payout Options

- A Big Selection of Slingo Games

- Great Customer Support

- User-Friendly Interface

- Inaccessible in Some Areas

- Accepts Only British Pound

- Welcome Bonus is Limited to UK Players

Go to Pub Casino!

Go to Pub Casino!

Pub Casino

- Fast payment options.

- SSL Data Encryption Security

- Various responsible gambling options available

Bonus Terms

Welcome bonus for new players only | Maximum bonus is 100% up to £100 | Min. deposit is £10 | No max cash out | Wagering is 45x bonus | Maximum bet with an active bonus is £5 Eligibility is restricted for suspected abuse | Skrill & Neteller deposits excluded for welcome bonus | Cashback when offered, applies to deposits where no bonus is included | Cashback is cash with no restrictions |

100% up to £100If you’re looking for an online gambling establishment that provides not just the standard fare of table games and live dealer options but also some of the top slot machines in the industry, you should check out Pub Casino! Pub Casino offers a wide selection of games, great signup bonuses, prompt payments, helpful customer service, ... READ FULL REVIEW

- Big Time Gaming

- Blueprint

- Elk Studios

- Evolution Gaming

- Eyecon

- Hacksaw Gaming

- Inspired

- Microgaming

- NetEnt

- Nolimit City

- Novomatic

- Play 'N Go

- Pragmatic Play

- Red Tiger

- Slingo

- Thuderkick

- Huge Slot Library

- Fast Payout Options

- A Big Selection of Slingo Games

- Great Customer Support

- User-Friendly Interface

- Inaccessible in Some Areas

- Accepts Only British Pound

- Welcome Bonus is Limited to UK Players

Slots are a popular choice among both gambling enthusiasts and veterans, mostly due to their ease of play and visuals.

Pub Casino prides itself on an enormous slot library of more than 1,400 slots packed into a straightforward layout and navigation. The UK online casino offers the most sought-after games today and all-time favorites, jackpots, and video slots.

In addition to a huge slot game library, Pub Casino has a huge collection of Slingo games you can play on your own or with others. In case you stumble upon any issues, great customer support is there to help you resolve them.

On the negative side, Pub Casino isn’t accessible to all parts of the world. More precisely, it’s inaccessible in 50 countries, including Germany, Bulgaria, France, Greece, etc. Plus, with the GBP being the only acceptable currency, the welcome bonus is restricted to UK players only.

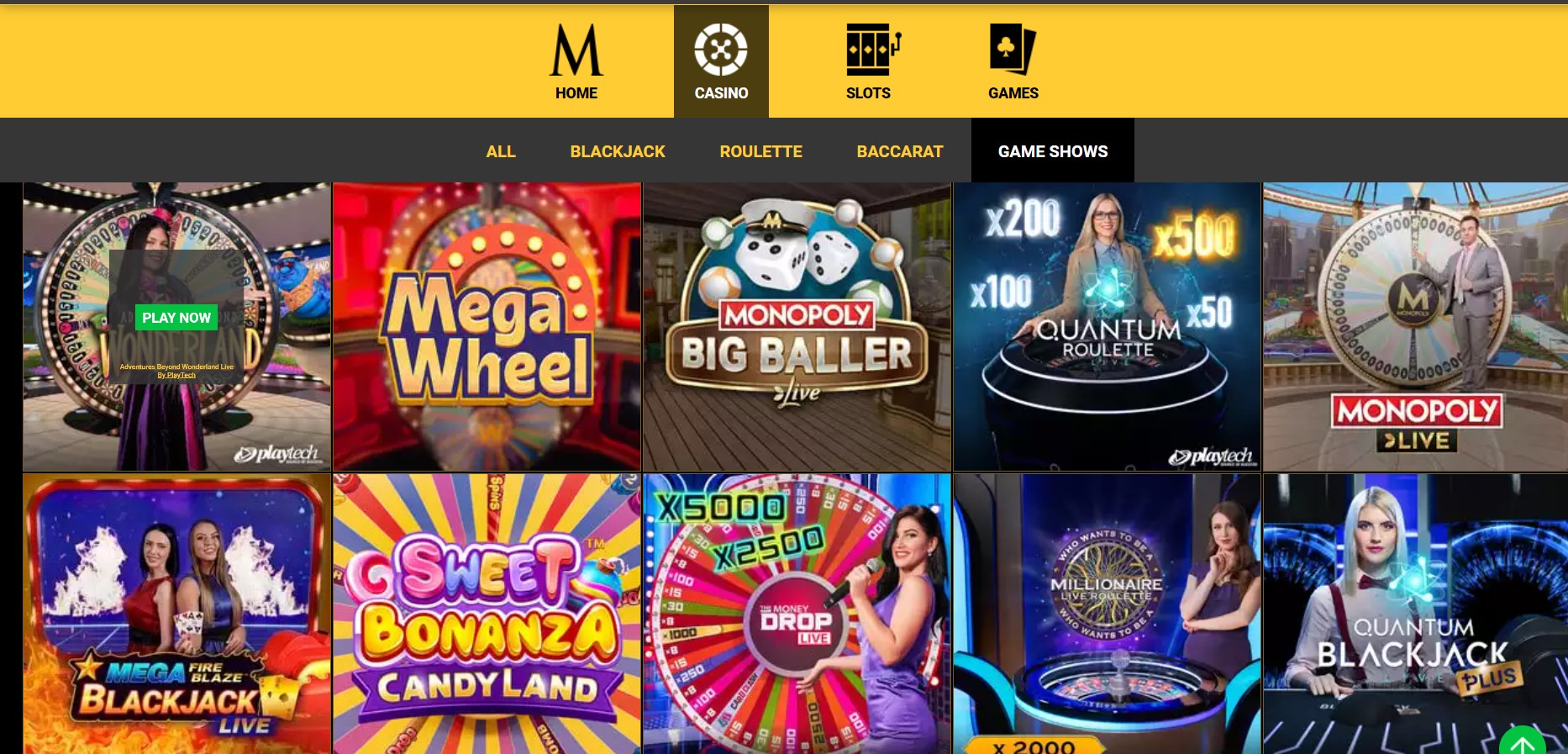

Best Casino for Live Dealer Games

1

Bonus Terms

New depositing players only. Min.1st deposit £10. Min. 2nd and 3rd deposits £20. First deposit is 50% bonus up to £50 + 20 Spins on Starburst; second one is 50 % Bonus up to £75 + 40 on Book of Dead; third deposit brings 50 % Bonus up to £75 + 40 on Legacy of Dead. Bonuses that require deposit, have to be wagered 35x. Deposits may be withdrawn before a player’s wagering requirements have been fulfilled. However, if this occurs, all bonuses and winnings will be voided. Winnings received through the use of the extra bonus (no deposit) or extra spins shall not exceed £100.

100 spins + bonus up to £200

Online Casino: Vegasland * NEW *

Established: 2022

Company: Marketplay Limited

UK Gambling Licence link: 39483

Platform: Aspire Global

Banking options: Bank Wire Transfer, EcoPayz, MasterCard, Neteller, Paysafe Card, instaDebit, Visa, Entropay, EPS, Euteller, Bancontact/Mister Cash, Fast Bank Transfer, Trustly, Skrill, Wire Transfer, Skrill 1-Tap, Zimpler, Klarna Instant Bank Transfer, MuchBetter, Rapid Transfer, PayPal, Interac, AstroPay Card, CashtoCode, GiroPay

Mobile options: Over 1100 mobile games

If you are looking for a casino with a huge library of slot and live dealer games and a variety of sports you can bet on, VegasLand Casino is exactly what you are looking for! Not only can you play your favorite games both on your desktop and mobile browser, but you can also ... READ FULL REVIEW

- 1X2gaming

- Ainsworth

- Aristocrat

- Bally

- Barcrest

- Betsoft

- Big Time Gaming

- Blueprint

- Booongo

- Cadillac Jack

- Elk Studios

- Evolution Gaming

- Ezugi

- GameArt

- Habanero

- High 5 Games

- IGT

- Inspired

- Irondog

- iSoftBet

- Lightning Box

- Magnet Gaming

- Microgaming

- NeoGames

- NetEnt

- NextGen

- Nolimit City

- NYX

- Old Skool Studios

- Oryx

- Pariplay

- Play 'N Go

- Playtech

- Pragmatic Play

- Quick Spin

- Quickfire

- Rabcat

- Realistic

- Red Rake

- Scientific

- SG Digital

- Skillzzgaming

- SYNOT

- Thunderkick

- Tom Horn Gaming

- Triple Edge Studios

- WMS

- Daily Spin Frenzy

- Integrated Sportsbook

- Established Company

- No USA players

Go to Vegasland!

Go to Vegasland!

Bonus Terms

New depositing players only. Min.1st deposit £10. Min. 2nd and 3rd deposits £20. First deposit is 50% bonus up to £50 + 20 Spins on Starburst; second one is 50 % Bonus up to £75 + 40 on Book of Dead; third deposit brings 50 % Bonus up to £75 + 40 on Legacy of Dead. Bonuses that require deposit, have to be wagered 35x. Deposits may be withdrawn before a player’s wagering requirements have been fulfilled. However, if this occurs, all bonuses and winnings will be voided. Winnings received through the use of the extra bonus (no deposit) or extra spins shall not exceed £100.

100 spins + bonus up to £200Online Casino: Vegasland * NEW *

Established: 2022

Company: Marketplay Limited

UK Gambling Licence link: 39483

Platform: Aspire Global

Banking options: Bank Wire Transfer, EcoPayz, MasterCard, Neteller, Paysafe Card, instaDebit, Visa, Entropay, EPS, Euteller, Bancontact/Mister Cash, Fast Bank Transfer, Trustly, Skrill, Wire Transfer, Skrill 1-Tap, Zimpler, Klarna Instant Bank Transfer, MuchBetter, Rapid Transfer, PayPal, Interac, AstroPay Card, CashtoCode, GiroPay

Mobile options: Over 1100 mobile games

If you are looking for a casino with a huge library of slot and live dealer games and a variety of sports you can bet on, VegasLand Casino is exactly what you are looking for! Not only can you play your favorite games both on your desktop and mobile browser, but you can also ... READ FULL REVIEW

- 1X2gaming

- Ainsworth

- Aristocrat

- Bally

- Barcrest

- Betsoft

- Big Time Gaming

- Blueprint

- Booongo

- Cadillac Jack

- Elk Studios

- Evolution Gaming

- Ezugi

- GameArt

- Habanero

- High 5 Games

- IGT

- Inspired

- Irondog

- iSoftBet

- Lightning Box

- Magnet Gaming

- Microgaming

- NeoGames

- NetEnt

- NextGen

- Nolimit City

- NYX

- Old Skool Studios

- Oryx

- Pariplay

- Play 'N Go

- Playtech

- Pragmatic Play

- Quick Spin

- Quickfire

- Rabcat

- Realistic

- Red Rake

- Scientific

- SG Digital

- Skillzzgaming

- SYNOT

- Thunderkick

- Tom Horn Gaming

- Triple Edge Studios

- WMS

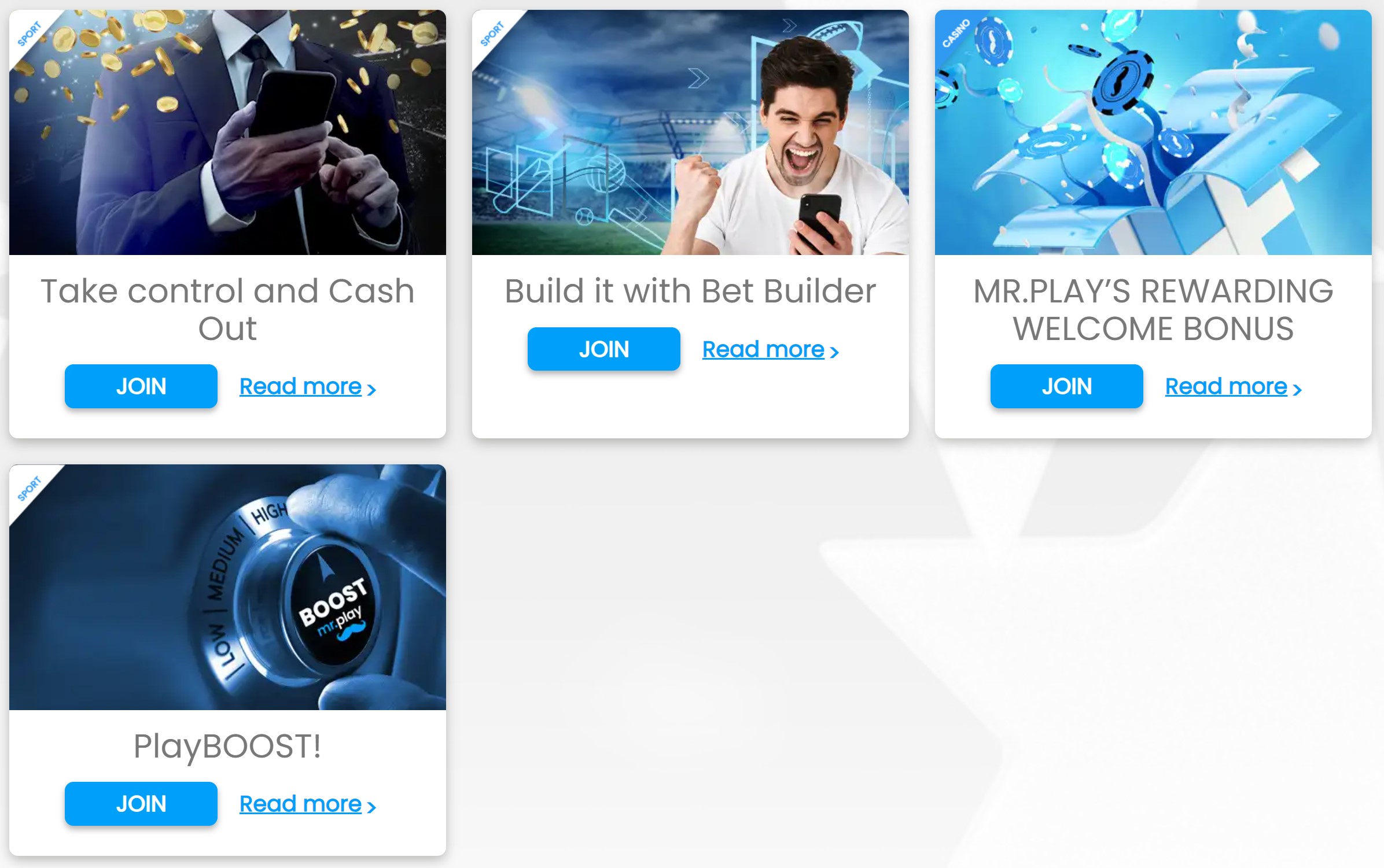

- Daily Spin Frenzy

- Integrated Sportsbook

- Established Company

- No USA players

If live dealer games like blackjack, roulette, or baccarat are your cup of tea, look no further than VegasLand Casino. All games are created by industry giants, including NetEnt, Play’n Go, and Blueprint Gaming, to name a few.

What’s even better, all the games are mobile friendly, so you can play them literally everywhere, provided that you have a mobile device and an internet connection.

The interface is user-friendly and easy to navigate, so you can fund all the games with little to no effort.

Unfortunately, despite helpful customer support, there is no live chat option, so the support team is not technically reachable 24/7. VegasLand Casino is not available everywhere, and in countries where you can play at the casino, the withdrawal limit per month is 7,000 USD (the UK excluded).

Online Casino with the Best Sign-up Bonus

1

Captain Spins

- 128-bit encryption technology safety feature

- Uses latest firewalls

- White Hat Gaming Casino

Bonus Terms

18+. New players only. One welcome package per player. Max bonus bet £5, Min deposit £20 1st deposit: get 100 bonus spins, 2nd Deposit: get 120 bonus spins, 3rd deposit: get 140 bonus spins, 4th deposit: get 160 bonus spins. All spins are on slot game Book of Dead only. Bonus funds must be used within 30 days and bonus spins within 10 days. Max winnings from bonus spins are equivalent to thenumber of spins awarded. Spins winnings credited as bonus. Bonus funds separate to Cash funds, andare subject to 35x wagering and withdrawal requirements. Full Terms Apply BeGambleAware.org

Up to 520 bonus spins package

Online Casino: Captain Spins

Established: 2019

Company: White Hat Gaming Limited

UK Gambling Licence link: 52894

Banking options: Visa, Mastercard, Maestro, Paypal (UK only), Skrill, Neteller & Bank Transfer

Mobile options: Mobile app and Mobile website version

Captain Spins Casino is one of the industry’s most successful gambling websites, offering various games, loads of promotions and bonuses, and plenty of cool features. Basically, it has everything you need to enjoy some proper gambling. But what exactly can you expect from Captain Spins Casino? If you’re looking for answers, you’ve come to the ... READ FULL REVIEW

- 1X2gaming

- Elk Studios

- Evolution Gaming

- Microgaming

- NetEnt

- Play 'N Go

- Quick Spin

- Realistic Games

- Red Tiger

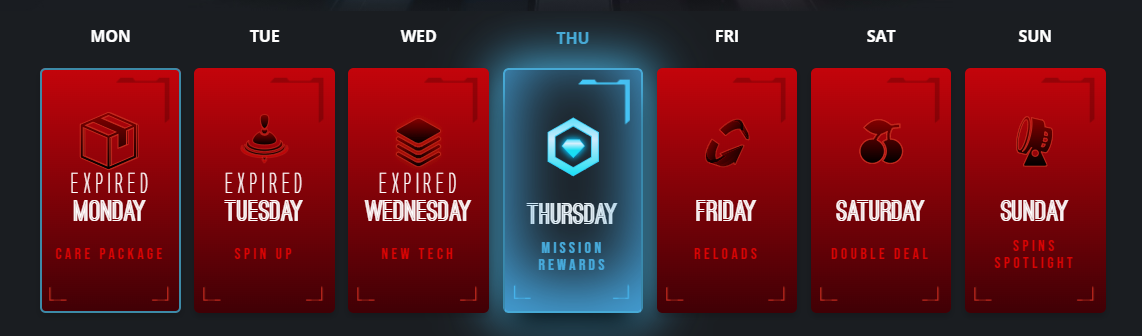

- Nicely Designed Website

- Promotions Calendar

- Loyalty Program

- Generous Welcome Offer

- Favorite Games Section

- Lack of Poker Games

- No Support for Cryptocurrencies

Go to Captain Spins!

Go to Captain Spins!

Captain Spins

- 128-bit encryption technology safety feature

- Uses latest firewalls

- White Hat Gaming Casino

Bonus Terms